Editor's PiCK

Bitcoin turns back to an uptrend...warming up for a Q4 rally?

Summary

- Bitcoin price returned to an uptrend after one week and recovered to the $112,000 range.

- It stated that the historical October average rise was 22%, and that the Uptober phenomenon and on-chain indicators such as MVRV are also positive.

- There is a view that if the U.S. rate-cut cycle takes hold, Bitcoin could set a new high within the year, but economic and market uncertainties were pointed out as downside risk factors for Q4.

Bitcoin recovers to the $112,000 range

10-year October average rise 22%

On-chain indicators such as MVRV also positive

"Will benefit from a rate-cut cycle"

Bitcoin (BTC) prices have returned to an uptrend after one week. The market is dominated by the view that Bitcoin will show strength this October. There is also speculation that it could hit a new record high within the year.

According to cryptocurrency market streaming site CoinMarketCap on the 29th, Bitcoin surpassed $110,000 that day and continued its rise, trading in the $112,000 range. Over the past weekend (27–28), it showed weakness and fell to the $108,000 range before successfully rebounding.

Earlier, Bitcoin prices had continued to fall last week, heightening investor concerns. Some analyses suggested that Bitcoin's upward momentum weakened after the Fed's September Federal Open Market Committee (FOMC). Amid such concerns, U.S. spot Bitcoin exchange-traded funds (ETFs) saw net outflows of $900 million (about 1.3 trillion won) last week. It was the first weekly net outflow in five weeks. On-chain analytics firm Glassnode analyzed that "ETF inflows, which played a key role in absorbing (Bitcoin) supply, slowed sharply around the FOMC."

However, growing expectations of rate cuts ahead of October appear to have fueled Bitcoin price gains. The Fed had initially hinted at the possibility of two additional rate cuts this year at this month's FOMC, but recent U.S. economic indicators such as second-quarter gross domestic product (GDP) were stronger than expected, leading to views that further rate cuts might be off the table. But the U.S. August personal consumption expenditures (PCE) price index released on the 26th matched the Dow Jones-compiled consensus, reviving the weakened prospect of rate cuts.

'Uptober' hopes grow

The view that the 'Uptober' phenomenon is likely to repeat is gaining traction. 'Uptober' is a portmanteau of 'Up' and 'October' and refers to the phenomenon in which the cryptocurrency market generally shows strength every October. According to Coinglass, over roughly 10 years from 2013 to last year, Bitcoin's average October increase was 21.89%. Also, looking only at October, the only years Bitcoin's price did not rise were 2014 and 2018.

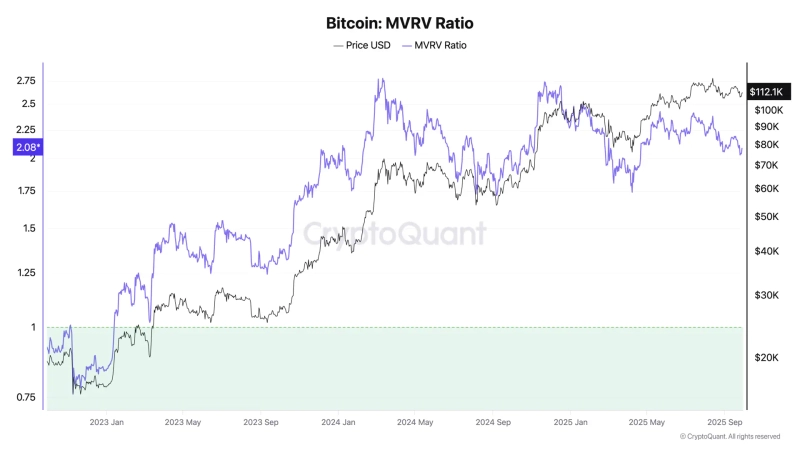

On-chain indicators are also optimistic. A representative is the "market value to realized value (MVRV)," which divides Bitcoin market capitalization by realized capitalization (Realized Cap). A CryptoQuant contributor at XWIN Research Japan said, "(Bitcoin MVRV) ratio has returned to around 2.0," adding, "that zone is neither fear nor euphoria." He went on to analyze, "In past cycles, after an initial surge in (Bitcoin) prices, when MVRV adjusted in that zone the trend was reset and (afterwards) it entered a strong bullish phase." Generally, MVRV of 1.0 or less is considered undervalued, and 3.7 or more is considered overvalued.

There is also analysis that if the U.S. rate-cut cycle becomes full-fledged, Bitcoin could break its record high within the year. On Polymarket, as of that day the probability that Bitcoin will exceed $125,000 within the year stood at 66.6%. It rose 6 percentage points from the previous day's 60.6%. U.S. cryptocurrency asset manager Grayscale said, "Rate cuts lower the opportunity cost of zero-yield assets and raise investors' risk appetite, which will benefit cryptocurrencies," adding, "(However) U.S. labor market weakness, high valuations in the stock market, and geopolitical uncertainty could act as downside risk factors in Q4."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)