Editor's PiCK

Last week global cryptoasset investment products saw net outflows of $800 million

Summary

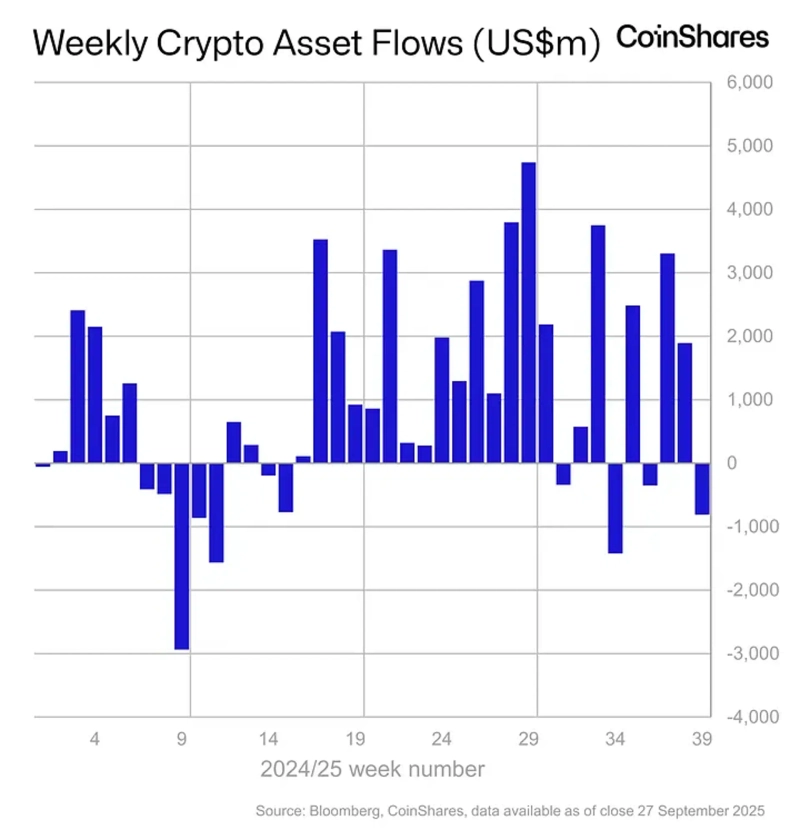

- CoinShares said that last week global cryptoasset investment products saw net outflows of $812 million.

- It reported that Bitcoin and Ethereum products experienced large outflows, while altcoins such as Solana and XRP received inflows on hopes of ETF approval.

- The report said year-to-date cumulative inflows remain substantial and projected they could surpass last year's peak of $48.6 billion.

Last week, global cryptoasset (cryptocurrency) investment products saw outflows of $812 million (KRW 1.1386 trillion).

On the 29th (local time), CoinShares said in a report, "Last week, cryptoasset investment products saw net outflows of $812 million," adding, "This is the effect of strong macroeconomic data being released one after another, which has lowered expectations for a US interest rate cut."

However, it said upward momentum remains. The report added, "Cumulative inflows into investment products are still substantial," and "Year-to-date cumulative inflows total $39.6 billion, so they could easily surpass last year's peak of $48.6 billion."

By asset, Bitcoin (BTC) products saw outflows of $719 million. The report said, "While Bitcoin products recorded outflows, short (selling) Bitcoin products also lacked demand," adding, "This indicates that the negative sentiment may be temporary." Ethereum (ETH) saw $409 million flow out. September's total net inflows also plunged to $86.2 million.

Meanwhile, major altcoins showed a positive trend. Solana (SOL)-based investment products saw net inflows of $291 million last week. XRP also saw inflows of $93.1 million, showing a good trend. The report analyzed, "Both assets recorded inflows on hopes of an exchange-traded fund (ETF) approval."

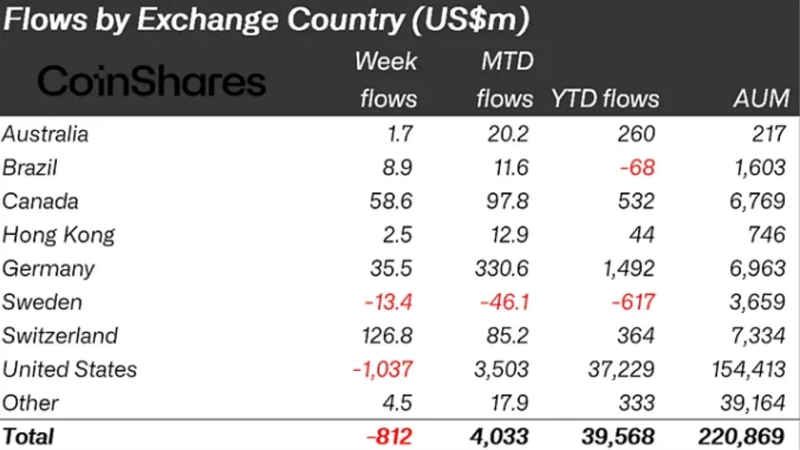

By country, outflows originating from the US were strong. US-based cryptoasset products alone saw net outflows of about $1.037 billion, and Sweden saw $13.4 million flow out. Conversely, Switzerland, Canada, and Germany saw inflows of $126.8 million, $58.6 million, and $35.5 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)