Summary

- Recent Bitcoin price gains were driven by spot demand and long-term holders, according to analysis.

- On-chain indicators showed no clear sell signals.

- With funding rates remaining low as prices rise, there is a strong possibility of a further rally.

Recent analysis suggested that spot demand has driven the recent rise in Bitcoin (BTC) prices. Observers also see a high possibility of additional rallies.

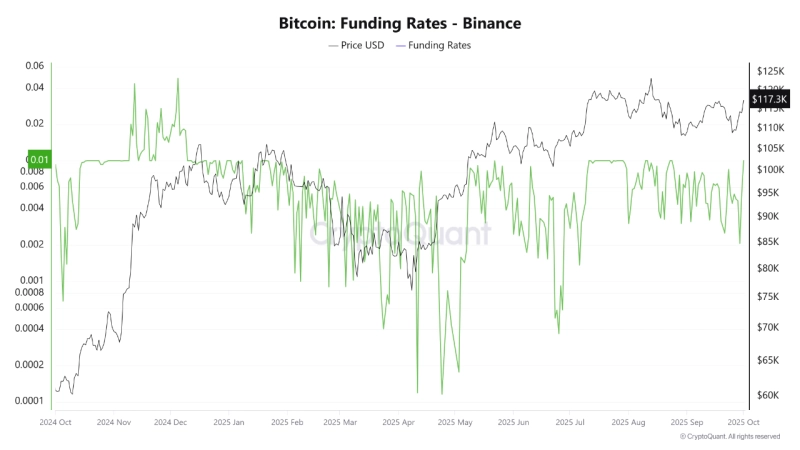

PelinayPA, a CryptoQuant contributor, wrote on the 1st (local time) via CryptoQuant that "Bitcoin is currently holding strength in the $110,000~$120,000 range" and that "funding rates are generally neutral or negative." He said, "Normally high prices induce excessive long position leverage and positive funding rates, but currently the opposite is happening," and analyzed that "this price rise appears to be driven by spot demand and long-term holders rather than leverage."

On-chain indicators also do not show clear signs of selling. PelinayPA explained, "There are no sell signals in the current structure," because "the funding rate has not entered an overheated positive zone." He added, "In the short term, negative funding rates support the possibility of a rapid short squeeze."

He also emphasized the potential for further upside. PelinayPA said, "When prices rise while funding rates remain low, it is a healthy rally driven by spot demand rather than leverage," and predicted that "in the mid-term, spot demand could lift Bitcoin to $120,000 to $125,000."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)