Editor's PiCK

Last week global crypto asset investment products saw $5.95 billion in net inflows…"largest ever"

Summary

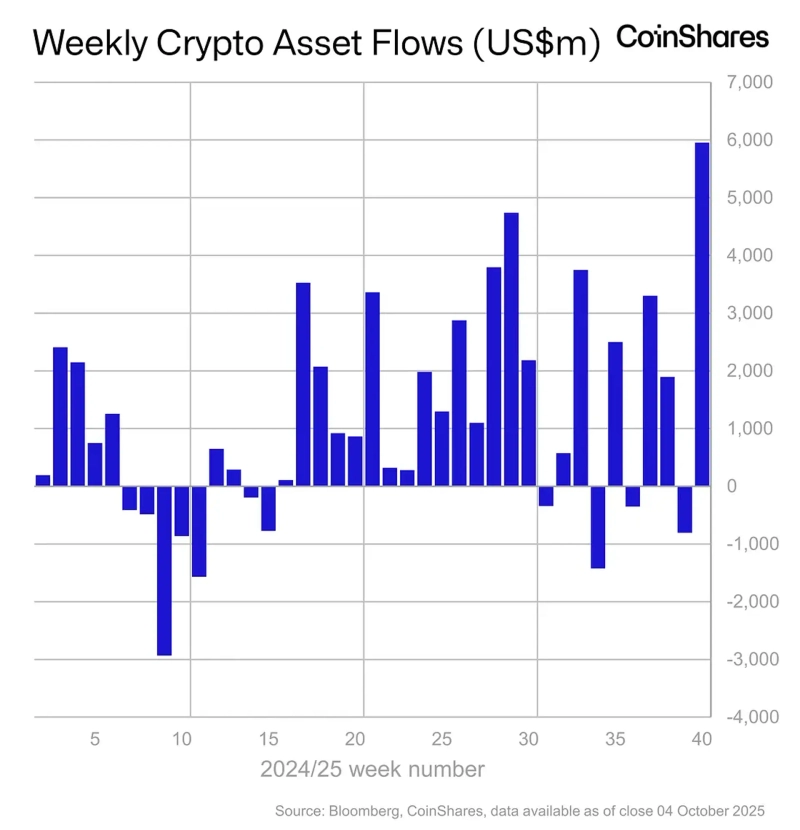

- CoinShares said global crypto asset investment products saw net inflows of $5.95 billion last week, marking the largest amount on record.

- In particular, Bitcoin investment products saw $3.55 billion inflows, setting a record for weekly inflows, and Ethereum also saw $1.48 billion in inflows.

- It said the net inflows were driven by increased interest after weak U.S. employment data and a government shutdown, and that inflows originating from the U.S. were strong by country.

Last week, global crypto asset (cryptocurrency) investment products saw net inflows of $5.95 billion (₩8.4157 trillion).

On the 6th (local time), CoinShares said in a report, "Last week crypto asset investment products saw net inflows of $5.95 billion," adding, "This is the largest weekly inflow on record." It added, "This reflects increased interest in crypto assets after weak employment data and a U.S. government shutdown," and "the total assets under management (AUM) of global investment products also reached an all-time high of $254 billion."

By asset, Bitcoin (BTC) products recorded the largest inflows. Bitcoin saw $3.55 billion come in, setting a record for weekly inflows. The report added, "Last week Bitcoin's price rose significantly, but investors still are not buying short (sell) Bitcoin products."

Ethereum (ETH) received $1.48 billion. Year-to-date (YTD) inflows have surged to $13.7 billion.

Major altcoins showed a positive trend. Solana (SOL)-based investment products had net inflows of $706.5 million last week. XRP also saw $219.4 million come in, showing a positive trend. However, the report said, "Inflows to other altcoins, excluding those two assets, were negligible."

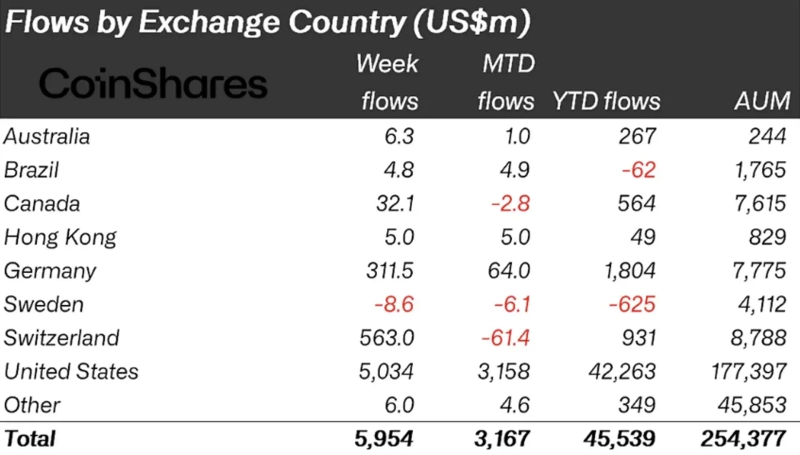

By country, inflows originating from the U.S. were strong. U.S.-based crypto products alone had net inflows of about $5.034 billion, while Switzerland and Germany saw $565 million and $312 million, respectively. Sweden, on the other hand, experienced an outflow of $8.6 million.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)