Editor's PiCK

"The rally isn't over"… Bitcoin nearing the 200 million-won mark

Summary

- It reported that Bitcoin recently surpassed 177 million won in KRW terms, marking a record high.

- It noted that U.S. Bitcoin spot ETFs have seen net inflows for nine consecutive trading days, indicating strong investor sentiment.

- On-chain and spot signals remain positive, and the Bitcoin rally could continue amid increased short-term volatility.

Taking a breather after record high

Exceeds 170 million won in the KRW market

ETFs see net inflows for nine consecutive trading days

"Prediction: exceed $130,000 this month"

Bitcoin (BTC) prices, which rose sharply during the Chuseok holiday period, have taken a breather in the upper $121,000 range. Market sentiment largely holds that the Bitcoin rally will continue for the time being.

According to cryptocurrency market data site CoinMarketCap on the 10th, as of 6:30 p.m. Bitcoin was trading in the upper $121,000 range, up 0.05% from the previous day. Earlier, Bitcoin's price surpassed $126,000 for the first time on the 7th. It set a new record only a week after turning upward this month.

Bitcoin also set a record high in the KRW market. The price exceeded 170 million won for the first time on the 2nd of this month, just before the Chuseok holiday. On domestic cryptocurrency exchange Upbit, Bitcoin was trading in the 177 million won range as of 6:30 p.m. that day. The so-called 'kimchi premium' has also intensified, with domestic prices about 2.5% higher than international rates.

U.S. ETFs also in a 'net inflow streak'

Market participants say the Bitcoin rally is not over yet. The term 'Uptober' reflects that Bitcoin prices have tended to be strong every October. According to CoinGlass, the October average increase in Bitcoin prices over roughly the 10 years from 2013 through last year was nearly 22%. On-chain analysis firm Glassnode recently described the Bitcoin rise as an "Uptober breakout" and said "on-chain and spot signals remain positive."

Analysts also say profit-taking pressure is not large. CryptoQuant said in its weekly report on the 9th that "short-term holders have sold at about a 2% return in recent days," which "is lower than the average 8% level seen at price peaks." It added that "realized returns for long-term holders are about 129%, leaving room compared with past peaks (about 300%)," and that "selling activity by long-term investors who have held Bitcoin for more than 10 years remains limited."

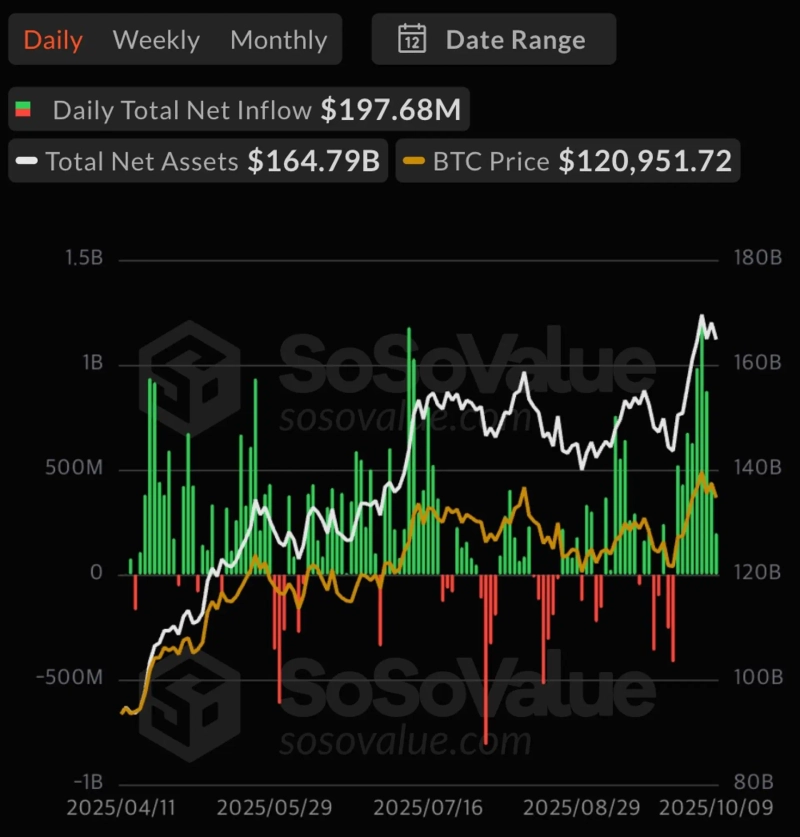

Institutional inflows are also positive. According to SosoValue, U.S. Bitcoin spot exchange-traded funds (ETFs) recorded net inflows of $198 million (about 280 billion won) as of that day, marking nine consecutive trading days of net inflows. In addition, Bitcoin spot ETFs have seen $5 billion (about 7.1 trillion won) of net inflows so far this month. That already exceeds last month's total net inflows ($3.5 billion) by about $1.5 billion.

"Short-term volatility increases"

Some observers say Bitcoin could exceed $130,000 as early as this month. The 'debasement trade'—betting on currency depreciation—has strengthened, drawing funds into non-monetary assets such as gold and Bitcoin. On the world's largest prediction market Polymarket, the probability that Bitcoin will exceed $130,000 in October was 44% as of that day. The probability that Bitcoin will exceed $130,000 within the year was 74%, 30 percentage points higher than the October measure.

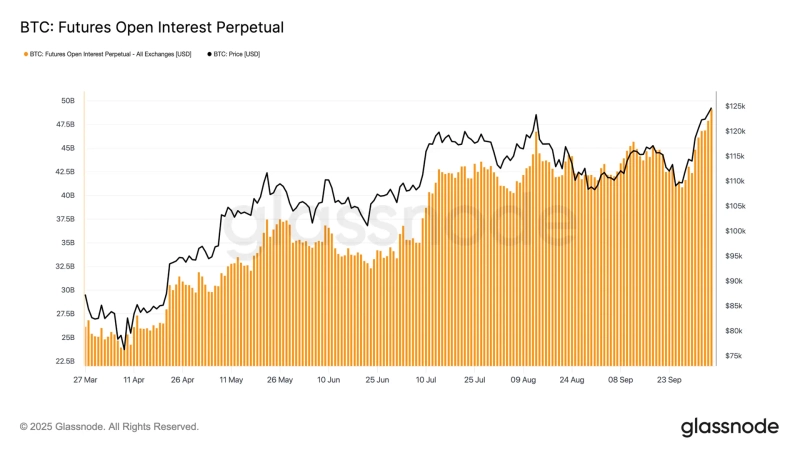

Whether a prolonged U.S. federal government shutdown continues is cited as a short-term variable. Currently, due to the federal government shutdown, statistical releases from key agencies such as the Commerce Department and the Department of Labor, which the Federal Reserve (Fed) uses as indicators for rate decisions, have been suspended. Glassnode analyzed that "the rise in Bitcoin prices has pushed futures open interest (OI) to record highs, increasing short-term volatility," and that "when open interest surges, excessive leverage tends to be resolved through liquidations or temporary corrections."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)