Summary

- It said that after former U.S. President Trump announced 100% tariffs on Chinese imports, the crypto asset (cryptocurrency) market experienced a sharp sell-off.

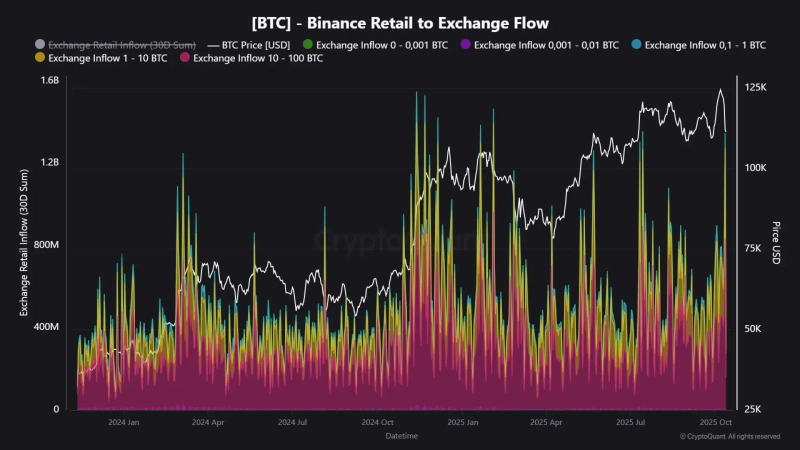

- Retail wallet addresses holding fewer than 100 bitcoins transferred about $1.359 billion worth of Bitcoin to Binance.

- It reported that retail investors' capital flows clearly tend to follow rather than predict market direction.

After former U.S. President Donald Trump announced 100% tariffs on Chinese imports, the crypto asset (cryptocurrency) market was swept by a rapid sell-off. Major altcoins including Bitcoin fell in unison, triggering large-scale selling, and notably, retail investors' fund movements were clearly observed.

On the 11th (local time), a Martune CryptoQuant contributor wrote in a report, "On the 11th, retail wallet addresses holding fewer than 100 bitcoins transferred about $1.359 billion worth of Bitcoin to Binance." This is one of the largest single-day amounts observed in the past year, suggesting the panic selling peaked.

The report added, "Recent surges in retail deposits of similar scale over the past year coincide with major price volatility moments such as March 5, 2024 ($1.286 billion), November 12, 2024 ($1.581 billion), and January 20, 2025 ($1.408 billion). This indicates that retail investors' capital flows tend to 'follow' market direction rather than 'predict' it."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)