Editor's PiCK

Synthetic dollar pegging collapse… US-China tensions also shake stablecoins

Summary

- USDe's value reportedly fell to as low as $0.65 at one point, causing a stablecoin de-pegging event.

- Synthetic dollars may be vulnerable because they maintain value through cryptocurrency derivatives and similar instruments, creating complex risks.

- The incident raised concerns about the stablecoin industry's credibility and the possibility of cascading risks in the market.

On the 11th, USDe's value temporarily collapsed

At one point during trading it fell to $0.65

Pegging maintained through combinations such as derivatives

"Could shake confidence in stablecoins"

Due to the fallout from US-China trade tensions, the value of some stablecoins has reportedly collapsed. There are concerns that this incident could have an adverse effect on the stablecoin industry.

According to global cryptocurrency exchange Binance on the 13th, the price of USDe briefly fell to $0.65 on the 11th. This is a 'de-pegging' phenomenon in which the value of a stablecoin pegged to $1 breaks. USDe is the world's third-largest stablecoin by market capitalization.

This is the first time USDe has experienced a de-pegging since its launch in February last year. US crypto-focused media CoinDesk reported, "This (de-pegging) incident affected the market as a whole," and added, "The price of Atena, Atena Labs' governance token (ENA), also fell by nearly 40% at one point."

The sudden drop in USDe's price occurred immediately after U.S. President Donald Trump declared he would impose a 100% additional tariff on China. Immediately after the president's announcement, prices of major cryptocurrencies such as Bitcoin (BTC) plunged, and within a single day $19 billion (about 27 trillion won) was forcibly liquidated in the futures market. Atena Labs, the issuer of USDe, stated, "Market instability and large-scale (futures) liquidations caused volatility in USDe's secondary market price," adding, "However, USDe's issuance and redemption functions all operated normally."

Impact of 'synthetic dollar risk'

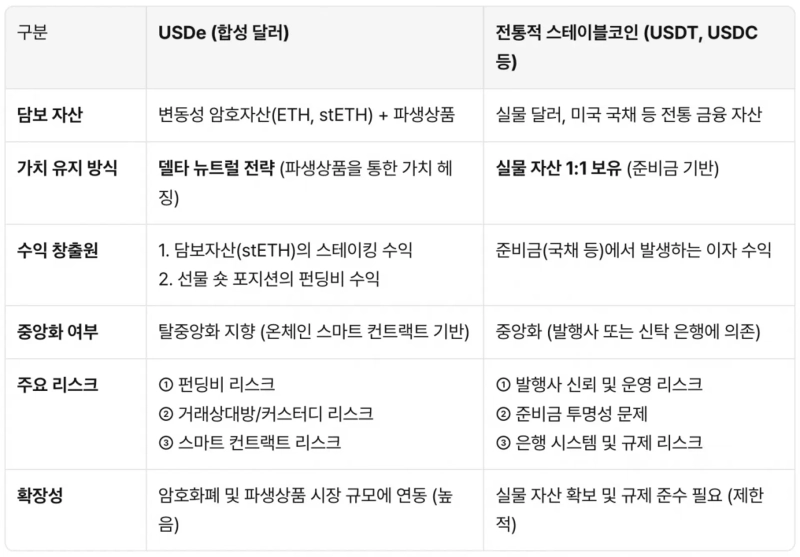

The de-pegging of USDe appears to have been influenced by the peculiarities of the 'synthetic dollar.' A synthetic dollar is a stablecoin that maintains a 1:1 value with the dollar by combining various financial products such as cryptocurrency derivatives. This contrasts with existing stablecoins like Tether (USDT) and Circle (USDC), which maintain a 1:1 value with the dollar by backing with traditional assets such as gold or U.S. Treasury bonds.

When USDe was launched last year it was initially noted as a next-generation stablecoin. Unlike Tether or Circle, it built a stablecoin system independent of traditional finance (TradFi). Domestic blockchain firm SuhoIO explained, "USDe is not directly linked to physical dollars or traditional financial assets," and said, "It aims to implement a 'crypto native' dollar asset that does not rely on a centralized issuer or banking system."

The problem lies in the risks of synthetic dollars. If the cryptocurrencies used as reserves plunge in value or liquidity in the derivatives market rapidly deteriorates, price volatility can increase. 'Overcollateralization,' securing reserves greater than the issued amount, is one of the keys to synthetic dollars. SuhoIO said, "(USDe) has the potential to raise the scalability and capital efficiency of decentralized finance (DeFi) to another level," but added, "Behind that potential exist complex risks not seen before, such as funding costs and counterparty risk."

"Closer to a tokenized hedge fund"

Attention is also focusing on the impact this incident may have on the stablecoin industry. Distortions in the price of a stablecoin that is fixed 1:1 to fiat currency can damage the industry's credibility. Rachel Lucas, BTC Market Analyst, said, "Even a brief wobble in a stablecoin's peg can have a big impact on the market," and pointed out, "Because investors use stablecoins for liquidity, lending, and collateral, any loss of confidence could trigger cascading liquidations."

Some argue that synthetic dollars are hard to classify as stablecoins. Shiming Xing, CEO of global cryptocurrency exchange OKX, said on X that day, "USDe should not be regarded as a stablecoin whose value is linked 1:1 to the dollar," and stated, "Its essence is closer to a tokenized hedge fund." He added, "Tokenized hedge funds are not designed by structure to be assets fixed 1:1 to the dollar," and cautioned, "If USDe is regarded as a stablecoin, it could create systemic risks across the cryptocurrency industry going forward."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)