Editor's PiCK

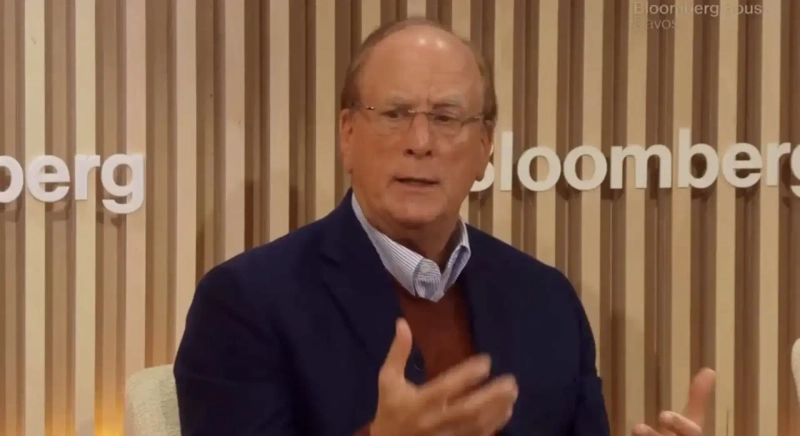

Larry Fink: 'Tokenization' — BlackRock's 10-year opportunity…accelerating the digital conversion of traditional assets

Summary

- Larry Fink, CEO, said that tokenization will be a new growth opportunity for BlackRock.

- BlackRock already operates the world's largest tokenized cash market fund, and said that blockchain-based securitization of assets will expand across the entire financial industry.

- CEO Fink emphasized that crypto assets play a meaningful role as an alternative asset for portfolio diversification.

Larry Fink, CEO of the world's largest asset manager BlackRock, said that "tokenization will be a new growth opportunity for BlackRock for decades to come." He said that traditional financial assets will gradually convert into digital forms, which he expects will expand inflows of individual investors.

On the 15th (local time) in an interview on CNBC's "Squawk on the Street," CEO Fink said, "If you tokenize and digitize ETFs, you can naturally connect investors who previously entered the market through crypto assets to traditional assets such as long-term retirement products," adding, "This will be a core opportunity for BlackRock going forward."

He added, "The tokenization of all assets—real estate, stocks, bonds—is only just beginning," and "blockchain-based securitization will expand across the financial industry." According to market research firm Mordor Intelligence, the global asset tokenization market is estimated at about 2 trillion dollars as of 2025 and is expected to grow to more than 13 trillion dollars by 2030.

BlackRock already operates the world's largest tokenized cash market fund, BUIDL (USD Institutional Digital Liquidity Fund). The fund was launched in March 2024 and has assets of 2.8 billion dollars. CEO Fink emphasized, "Several departments within the company are reviewing ways to expand tokenization strategies," and "BlackRock will play a leading role in this field."

BlackRock currently allocates about 104 billion dollars of its 13.46 trillion dollars in assets under management (AUM) to crypto-related assets, which represents about 1 percent of the total.

In a recent CBS "60 Minutes" interview, CEO Fink also said, "Crypto assets play a role similar to gold as a means of portfolio diversification," adding, "They should not be a large weight, but they play a meaningful role as an alternative asset." He explained that until 2017 he was skeptical, saying "cryptocurrencies were an indicator of money laundering," but that "over time I learned and grew," and he changed his stance.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)