Bank of Korea: "Won stablecoin should be issued through bank-led consortium"

Summary

- The Bank of Korea said a bank-led consortium is needed as the issuer of a won stablecoin.

- The BOK expects stablecoins to contribute to revitalizing the digital asset industry but said measures are needed to minimize potential risks such as foreign exchange regulations and separation of banking and commerce.

- The BOK will also pursue commercialization of deposit tokens in parallel, and said stablecoins and deposit tokens can coexist depending on market demand.

The Bank of Korea proposed a 'bank-led consortium' as the issuer of a won stablecoin. The reason given was that policy review related to existing regulations such as foreign exchange controls and the separation of banking and commerce is necessary.

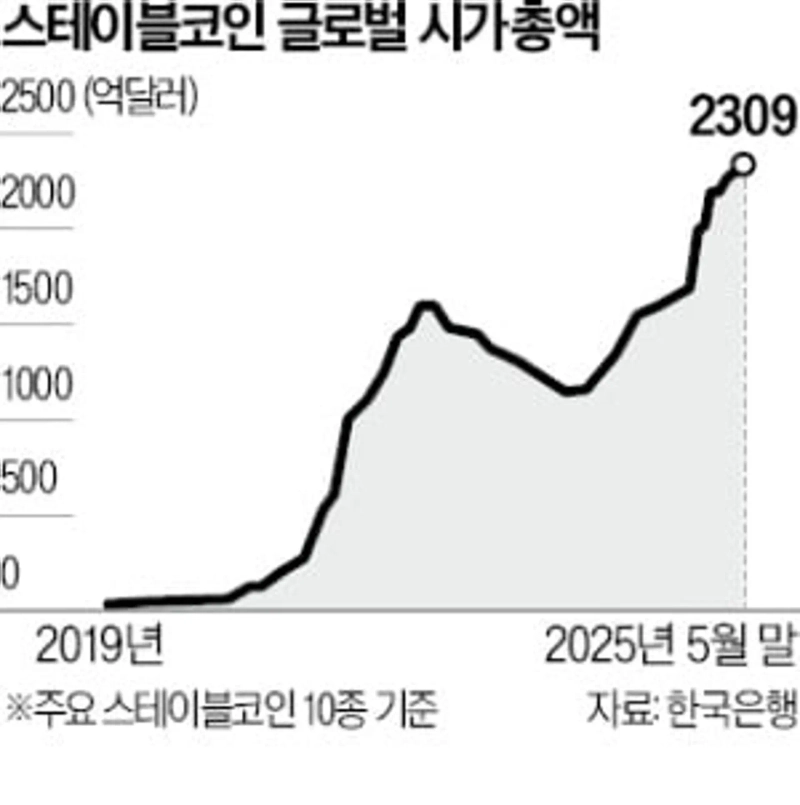

The Bank of Korea made this statement on the 20th during its work report at the National Assembly's Strategy and Finance Committee hearing held at the BOK headquarters on Namdaemun-ro, Seoul. The BOK expressed that it "in principle supports" issuance of a won stablecoin. It expects that if a stablecoin becomes a programmable currency through smart contracts and is used in digital platform environments, it will contribute to revitalizing the digital asset industry.

However, it emphasized the need to find ways to minimize potential risks. The BOK said, "Because a won stablecoin would be a currency substitute directly based on the value of fiat currency (won), it is necessary to minimize the wide-ranging impact on foreign exchange regulations, the structure of the financial industry, and monetary policy, as well as the potential risks arising from its introduction."

The BOK expressed concern that if a won stablecoin were issued based on an 'unpermissioned distributed ledger', it could be used as a means of cross-border fund movement that circumvents the foreign exchange regulatory system centered on foreign exchange banks. It also pointed out that allowing issuance by non-banks would conflict with the principle of separation of banking and commerce, such as permitting settlement-specialized banking, conflicts of interest between industrial and financial capital, and prevention of economic power concentration.

Considering these points, the BOK stated that "issuance through a bank-led consortium is necessary." It argued that it is desirable to first allow issuance centered on banks, which are already subject to high levels of regulation, to assess risks and then gradually expand.

Given the need for close cooperation among monetary, foreign exchange, and financial authorities, it also said that establishing a cross-ministerial policy body based on agreement among related ministries is necessary for regulatory responses. The BOK added, "The United States also required the establishment of a certification review committee composed of the Treasury, the Federal Reserve, and the Federal Deposit Insurance Corporation in the Genius Act."

The BOK also decided to pursue commercialization of deposit tokens, which it had been researching, in parallel. It conducted real-transaction usage tests from April to June, and plans to use them in a pilot project to improve state treasury management starting in the first half of next year. The BOK explained, "Deposit tokens will be used mainly in areas requiring payment stability, and stablecoins will be used mainly in the virtual asset ecosystem and cross-border remittance; they are expected to coexist in a competitive and complementary relationship depending on market demand."

Kang Jin-gyu reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.