Editor's PiCK

Ethereum Fusaka Upgrade…Could It Be the Signal for a Fourth-Quarter Rebound?

Summary

- The final test of the Ethereum (ETH) Fusaka (Fusaka) upgrade will take place at the end of this month, and it is expected to be applied to the mainnet in December.

- The upgrade is expected to improve Ethereum's network scalability and reduce fees, which could act as a catalyst for price increases.

- Increased demand for Ethereum's stablecoin industry and fourth-quarter price rise expectations have raised the possibility of surpassing $5,000 within the year.

Final test scheduled for the end of this month

If successful, applied to the mainnet in December

Significant improvement in network scalability

Possible catalyst for price increase

"Forecasts of surpassing $5,000 within the year"

Ethereum (ETH) Fusaka upgrade testing has entered its final stages. Attention is focused on whether the recently weak ETH price can rebound thanks to this upgrade.

According to industry sources on the 22nd, the final test of the Fusaka upgrade will be conducted on the Hoodi testnet on the 28th. If the final test scheduled for the end of this month is successfully completed, the Fusaka upgrade will be applied to the Ethereum mainnet on December 3 this year.

Preliminary tests for the Fusaka upgrade were carried out twice this month, on the 1st and the 14th. Both the first and second Fusaka upgrade tests were reported to have been successful.

The core of the upgrade is 'scalability.' The Ethereum Foundation said, "(The Fusaka upgrade) is a very important step in Ethereum's scalability roadmap," and added, "Key measures included in the upgrade improve blob throughput, Layer 1 performance, user experience (UX), including 'PeerDAS'." PeerDAS is a blockchain technology developed for the Fusaka upgrade.

Fees reduced by about 70%

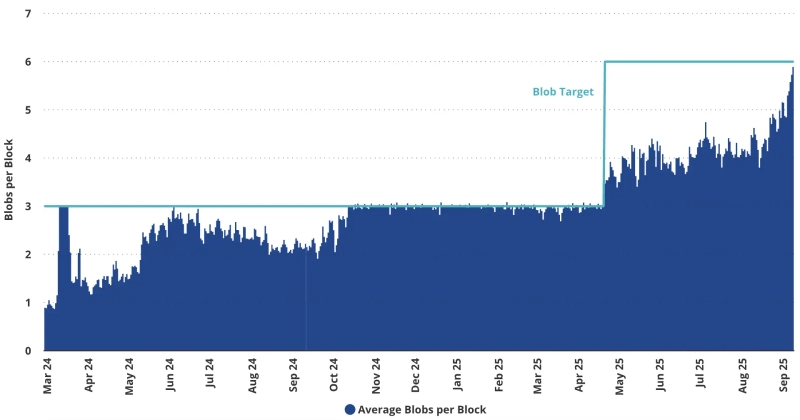

Specifically, the Fusaka upgrade increases the blob throughput per block for Ethereum Layer 2 networks from the existing 6 to 48 — an eightfold increase — through PeerDAS. A blob is a type of data storage space, and blob throughput is considered a key indicator of Ethereum's scalability. Vitalik Buterin, Ethereum co-founder, said, "(The Fusaka upgrade) is the key to Layer 2 scalability," adding, "(PeerDAS is) all new technology, so blob throughput will increase conservatively at first, but will expand gradually thereafter."

The market is closely watching the potential impact of the Fusaka upgrade on Ethereum's price, as mainnet upgrades have often acted as a driving force for price increases. The Pectra upgrade, which immediately preceded Fusaka, is a representative example. When the Pectra upgrade was applied in May, Ethereum's monthly average price increase was about 41%. Ethereum's price also exceeded $4,000 ahead of last year's Dencun mainnet upgrade, reaching a yearly high.

Analysts say this upgrade is also likely to be a catalyst for raising Ethereum's price. As Ethereum's scalability and efficiency improve and fee burdens decrease, demand centered on decentralized finance (DeFi) and other sectors could naturally increase. The industry expects that the Fusaka upgrade will reduce transaction fee burdens on Ethereum Layer 2 networks by about 70%.

VanEck, a U.S. asset manager, analyzed, "If blob throughput expands, rollup costs on Layer 2 will decrease, which will lead to reduced transaction costs for users," adding, "As a result, more on-chain economic activity will flow into the Ethereum ecosystem."

Stablecoin demand may also increase

The Fusaka upgrade could also be positive news as it may increase demand in the stablecoin industry. Ethereum is already regarded as a core infrastructure for stablecoin circulation. According to on-chain analytics platform RWAxyz, last month the transfer volume of stablecoins on the Ethereum network was $1.81 trillion (about 2,590 trillion won), accounting for about 57% of last month's total stablecoin transfer volume (about $3.16 trillion).

On-chain analytics firm Token Terminal predicted, "Over the next three years, $1.7 trillion worth of stablecoins will be newly issued on-chain," and added, "Even if Ethereum's market share falls from the current 60% to 50%, $850 billion worth of new stablecoins would be supplied on the Ethereum network within three years."

Investors' expectations are also raised by the fact that Ethereum has historically performed well in the fourth quarter each year. According to CoinGlass, from 2020 through last year (about five years), Ethereum's average annual fourth-quarter increase was about 36.4%. Some observers say that if Ethereum enters a full-fledged uptrend, surpassing $5,000 within the year would not be out of the question. Ethereum has not yet broken through the $5,000 barrier.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)