Summary

- This month Bitcoin spot trading volume has reportedly surpassed 300 billion dollars.

- It analyzed that recent large-scale liquidation events have led investors to move from the derivatives market to the spot market, strengthening preferences for conservative positions and direct holdings.

- Darkpost said the increase in spot trading volume is acting positively on the market and that the market's resilience is increasing.

This month, Bitcoin (BTC) spot trading volume has surpassed 300 billion dollars (about KRW 429 trillion).

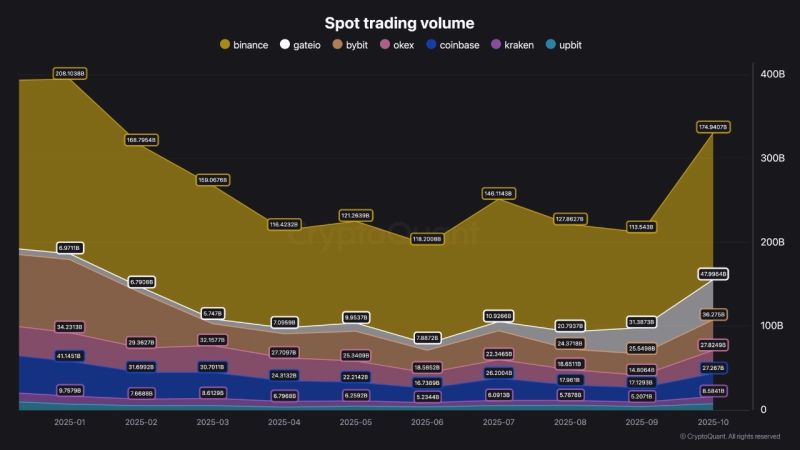

Darkpost, a contributor to CryptoQuant, said on the 30th (local time) via CryptoQuant, "This month's spot trading volume on major cryptocurrency exchanges has exceeded 300 billion dollars," adding, "Of this, 174 billion dollars occurred on Binance, recording the second-highest monthly trading volume this year."

Darkpost emphasized that recent large-scale liquidation events have increased demand for Bitcoin spot. Darkpost analyzed, "This trend shows that both retail and institutional investors are actively participating in the spot market," and added, "(Due to the large-scale liquidation events) investors appear to have moved from the derivatives market to the spot market, strengthening preferences for conservative positions and direct ownership."

The increase in spot trading volume is analyzed to act positively on the market. Darkpost said, "(The increase in spot trading volume is) a very positive signal," adding, "Markets that move toward spot trading rather than derivatives are generally healthier and more stable." It added, "(The increase in spot trading volume) shows that the market's 'organic demand' is strengthening and the overall market resilience is increasing."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)