Editor's PiCK

Solana falls despite ETF inflows..."Expectations priced in and macroeconomic uncertainty overlapped"

Summary

- Solana (SOL) reportedly recorded a price decline despite the recent launch of spot exchange-traded funds (ETFs) and significant inflows of institutional capital.

- The market pointed to 'expectations for ETFs being priced in' and macroeconomic uncertainty such as the U.S. federal government shutdown as causes of the price decline.

- In the short term, if Solana fails to hold key support levels, further declines are likely, and defending the 200-day moving average and recovering certain ranges are necessary.

Solana (SOL) has continued to decline in price despite recording large inflows following the recent launch of spot exchange-traded funds (ETFs). This is interpreted as the combined effect of 'expectations being priced in' from the ETF launches and macroeconomic uncertainty caused by the prolonged U.S. government shutdown.

Last week Solana drew market attention with the launches of spot ETFs including staking from Bitwise and Grayscale. Both products recorded significant inflows immediately after launch. In particular, Bitwise's Solana Staking ETF (BSOL), launched on the 28th (local time), saw net inflows of about $69.5 million (about KRW 100 billion) on its first trading day alone. This was the largest first-day inflow among ETFs launched this year.

According to CoinShares, Solana-based exchange-traded products (ETPs) recorded net inflows of $421 million (about KRW 606 billion) last week thanks to the ETF launches. This was the second-strongest weekly inflow.

Despite continuous inflows from institutional money, the price instead plunged. On the 4th, according to CoinMarketCap, Solana was trading at $157.86, down 10.6% from the previous day. Solana, which had once reached $205 on the 27th of last month just before the ETF launches, fell more than 20% in a week, the largest decline among major altcoins such as Ethereum (ETH) and Ripple (XRP).

Market participants pointed to two main reasons behind this decline. First is that the 'expectations for the ETF launches had already been priced in.' The economic magazine The Economic Times analyzed, "Expectations for the ETF launches spread across the market in advance and drove price increases, but after the actual launches profit-taking orders poured in."

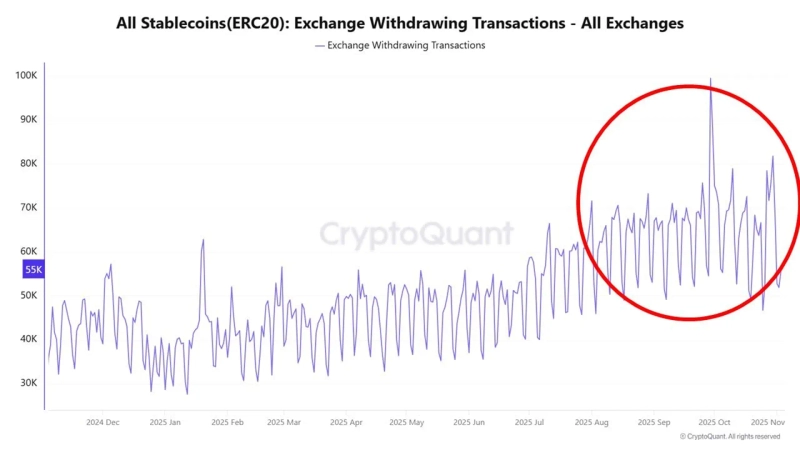

The second is uncertainty in macroeconomic variables. With the U.S. federal government shutdown dragging on, risk appetite for risky assets is generally weakening. Blockchain data firm CryptoQuant said, "Recent stablecoin withdrawal volumes from exchanges have reached record highs," adding, "Investors are exiting risky assets and moving into dollar-pegged assets." This suggests that market liquidity is gradually closing, and funds are moving to more stable stores of value.

Short-term additional corrections are also possible. Crypto-focused outlet BeInCrypto assessed, "If Solana falls below $178, there is a high possibility of further declines to $155," and diagnosed, "For recovery, it must break through $198 and close above $209."

CryptoRank, a crypto data platform, also analyzed, "If Solana fails to hold the $172 support line, it could be pushed down to $157 or $142." It added, "However, if it defends the 200-day moving average ($179.78) and recovers the $189–$200 range, it can regain short-term bullish momentum."

Su-hyun Lee, BloomingBit reporter shlee@bloomingbit.io

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)