Summary

- Tuttle Capital has filed a new product combining stocks and crypto asset ETFs with the U.S. SEC.

- The product reportedly provides weekly income distributions through put spread strategies on individual names.

- Remaining cash after margin usage will be invested in ETFs tracking major crypto assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

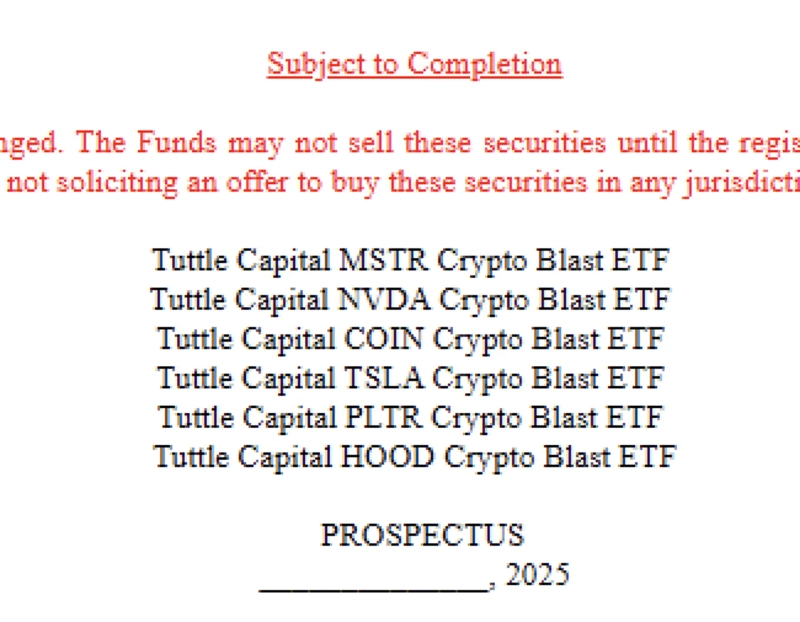

Tuttle Capital (Tuttle Capital Management) has registered with the U.S. Securities and Exchange Commission (SEC) a new type of product that combines stock and crypto asset (cryptocurrency) ETF investments.

On the 6th (local time), Bloomberg analyst Eric Balchunas said on X, "Tuttle Capital has filed for a 'Crypto Blast' ETF series that combines single-stock-based options strategies with crypto asset (cryptocurrency) ETF investments."

He added, "These ETFs will execute put spread strategies on individual names (single stocks) to provide weekly income distributions, while any cash remaining after margin usage will be invested in ETFs that track major crypto assets such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL)."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)