[Analysis] "Bitcoin MVRV ratio, signal of bottom formation…On-chain indicators remain robust"

Summary

- Bitcoin has recently shown high volatility, and extreme fear has formed in the market, but on-chain indicators remain robust.

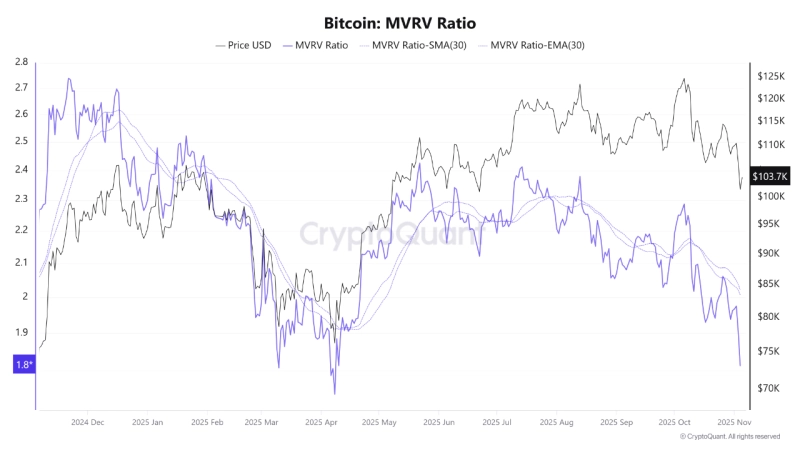

- In particular, the MVRV ratio has fallen to 1.8, showing patterns seen in past mid-term bottom ranges.

- The author analyzed that, as ETF inflows and structural liquidity factors persist, the 99,000~101,000 dollar range is likely to serve as a mid-term support.

Bitcoin (BTC) has recently shown high volatility, causing extreme fear in the market, but on-chain indicators are robust, according to analysis.

On the 6th (local time), CryptoQuant author XWIN Research Japan said, "It showed high volatility moving between 102,800~104,400 dollars. Overall risk-off sentiment strengthened and investor sentiment worsened, but nevertheless on-chain data show that the market is still solid."

According to the author, positions totaling 1.7 billion dollars were liquidated over the past day, mostly from long positions that used excessive leverage. Long-term holders (LTH) continue to take profits, but exchange holdings have continued to decline, and movement toward asset self-custody (self-custody) rather than selling is active. This is a typical pattern that appeared in past market stabilization phases.

A particularly notable indicator is the Bitcoin MVRV ratio (market value to realized value ratio). It is currently at 1.8, the lowest since April 2025, which means that market value is close to investors' average purchase price. Historical data show that when MVRV enters the 1.8~2.0 range, it often coincides with mid-term bottoms or early recovery phases.

Stablecoin flows also show a defensive nature. Tether (USDT) supply is about 183 billion dollars, and USD Coin (USDC) is at 75 billion dollars, supporting institutional payment demand. This suggests that idle liquidity remains abundant.

The author analyzed, "The current market is a transition rather than a collapse. Despite selling driven by fear, the scale of realized losses is limited, which is closer to rational position adjustments," and "As structural liquidity factors such as ETF inflows, asset tokenization, and expanded adoption by corporate treasuries are maintained, the 99,000~101,000 dollar range for Bitcoin is likely to act as a mid-term support."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)