[Analysis] "Ethereum, short-term selling pressure continues…year-end $5,000 recovery outlook"

Summary

- It reported that the Ethereum market has recently been dominated by short-term selling pressure.

- It stated that the current selling is a process of controlled profit-taking, not panic selling.

- It conveyed a forecast that the rebound toward a $5,000 recovery could resume by year-end.

Short-term selling pressure is dominant in the Ethereum (ETH) market, but an analysis says the uptrend is expected to be maintained in the medium to long term.

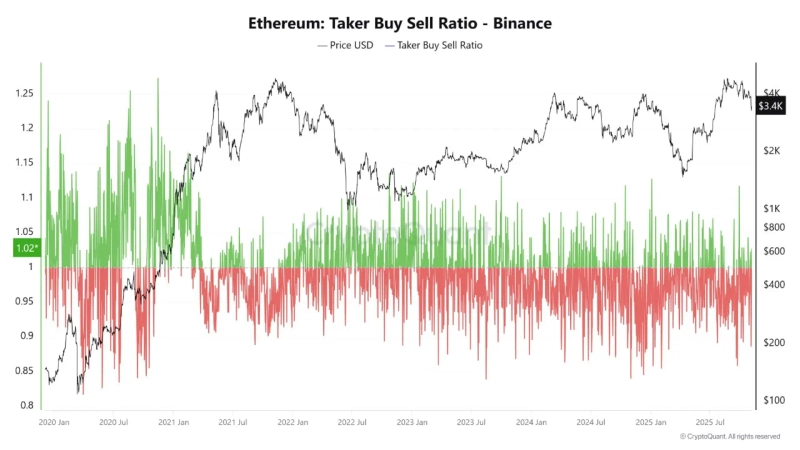

On the 6th (local time), CryptoQuant author PelinayPA said, "Recently, Binance's taker buy/sell ratio has remained at or below 1, showing a dominant selling flow. This is exerting short-term downward pressure on Ethereum's price, and a slowdown in buying momentum was observed even in the stable $3,400 range."

They added, "The current selling appears to be a process of controlled profit-taking rather than panic selling. Since the ratio is being maintained around 1.0, it is difficult to say that the uptrend itself has been broken." The author also forecasted, "There is a possibility of a short-term correction to the $2,955 support level, but if buying pressure re-enters at that level, a rebound toward a recovery of $5,000 by year-end could resume."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)