Editor's PiCK

Bitcoin barely holds $100,000…Market 'indifferent' despite Trump's remarks [Lee Su-hyun's Coin Radar]

Summary

- This week Bitcoin saw high volatility due to large-scale liquidations and selling by long-term holders, and $101,000 is cited as a key short-term pivot.

- Ethereum plunged amid U.S. institutional selling and outflows from spot Ethereum ETFs, and recovery to $3,500 is viewed as the key for a short-term rebound.

- Despite a partnership announcement with Mastercard, Humanity Protocol's price plunged, but DID and AI trust infrastructure interest supports its medium- to long-term growth potential.

<Lee Su-hyun's Coin Radar> examines the flow of the cryptoasset (cryptocurrency) market over a week and explains the background. Beyond simple price listings, it analyzes global economic issues and investor moves in a multidimensional way, providing insights to gauge market direction.

Major Coins

1. Bitcoin(BTC)

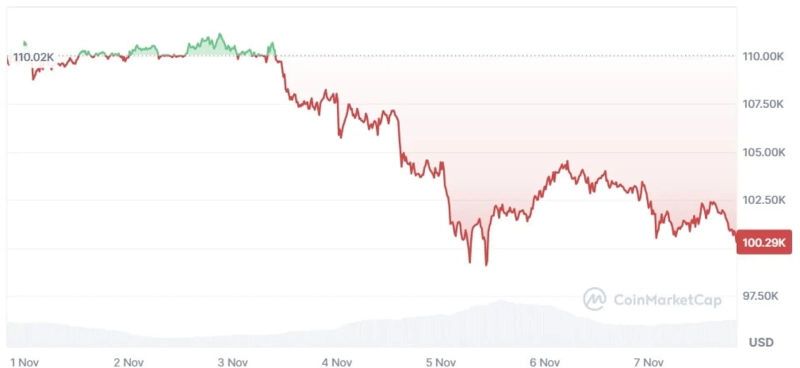

This week Bitcoin showed a mostly weak trend. On the 5th it fell as low as $99,000, alarming investors. On the 6th it attempted a rebound and briefly recovered to $104,000, but it has since given back some gains and is barely holding the $100,000 line by CoinMarketCap. Overall, it was a week of high volatility.

The decline is analyzed as having two main causes. First, market confidence was greatly shaken after a large-scale liquidation event on October 10. Citibank said in a report, "Market confidence was severely damaged after the large-scale liquidation event on October 10," diagnosing that "ETF demand weakening and deteriorating technical indicators combined to sharply worsen investor sentiment." Battle Runde, an analyst at K33, also said, "After the large-scale liquidation, liquidity constraints and fear psychology intensified the downtrend," and "most investors are hesitating to buy."

On top of this, selling by long-term holders compounded the effect. According to 10x Research data, over the past month about 400,000 coins, amounting to $45 billion, moved from long-term holder wallets to exchanges. A large release of 6-month to 1-year holdings has tightened market liquidity.

However, remarks by President Donald Trump on the 6th sparked a market rebound. President Trump said, "I will make the United States a Bitcoin superpower and the world's crypto capital," expressing continued support for Bitcoin. Also helping the rebound was news that discussions had resumed on the 'CLARITY' bill, the crypto regulation clarification bill whose talks had been halted by a shutdown. David Sacks, the White House advisor for cryptoassets and AI, said on his X, "Had constructive discussions with the Senate Agriculture Committee on the CLARITY bill. The bipartisan draft will be released soon."

Technically, $101,000 is currently cited as the short-term key support level. If it holds, a rebound possibility opens, but if it breaks, further adjustments are likely. Coveysi Research warned, "With weakening technical momentum, Bitcoin could be pushed down to $72,000." Still, long-term optimism remains. JP Morgan said, "Bitcoin is undervalued versus gold," and forecasted it could rise above $170,000 within 6–12 months. Jerry O'Shea, a Hashdex manager, predicted, "If the Fed ends quantitative tightening (QT) in December and expands liquidity, Bitcoin could retest its all-time high within months."

2. Ethereum(ETH)

Ethereum also had a tough week. On the 5th, when the decline deepened, it fell to $3,100, and as of the 7th it has slightly rebounded to $3,200 on CoinMarketCap. Weekly losses exceeded 14%, making it one of the hardest-hit major coins.

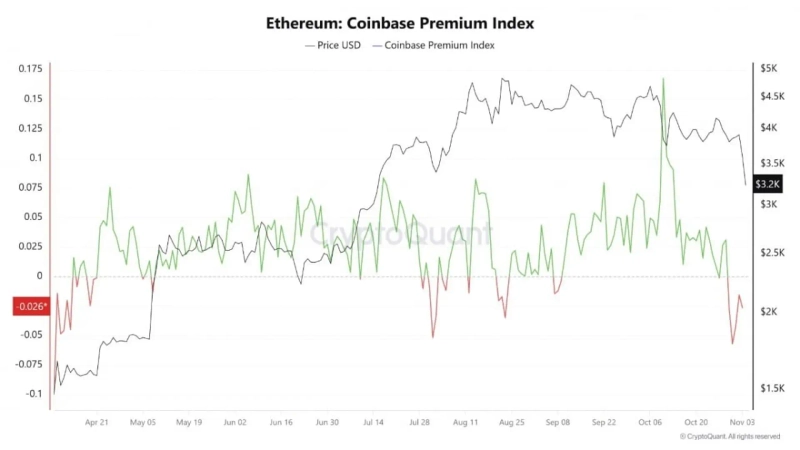

The sharp drop is attributed to selling by U.S. institutions and outflows from spot Ethereum ETFs. According to CryptoQuant, the Coinbase premium has turned negative and on the 31st of last month fell to -0.057, the lowest since April. This is interpreted as U.S. investors taking profits.

Large institutions like BlackRock have also shown selling moves. BlackRock transferred about 81,000 ETH (about $270 million) to Coinbase Prime this week alone. Typically, exchange deposits are seen as a sell signal. Funds also flowed out of U.S. spot Ethereum ETFs. Although they quickly turned to net inflows afterward, net outflows over the recent three days totaled $473.6 million (about 690.8 billion won).

Institutions that bought during the plunge have also recorded losses. In particular, Bitmain and Sharplink Gaming saw large valuation losses on their holdings. Bitmain recorded about $2.4 billion in losses based on an average buy price of $4,037, and Sharplink recorded about $170 million in losses based on an average buy price of $3,609.

Nonetheless, whale buying centered on Bitmain appears to continue. Bitmain bought more than 40,000 additional ETH this week, and whale wallets purchased about $1.1 billion over the past two days. This suggests that despite short-term adjustments, long-term confidence remains.

In the short term, recovery to $3,500 is key. If it fails to break that level, a correction to $2,800 could follow. But if it holds this zone, a rebound toward the $4,000 level may become possible.

3. XRP(XRP)

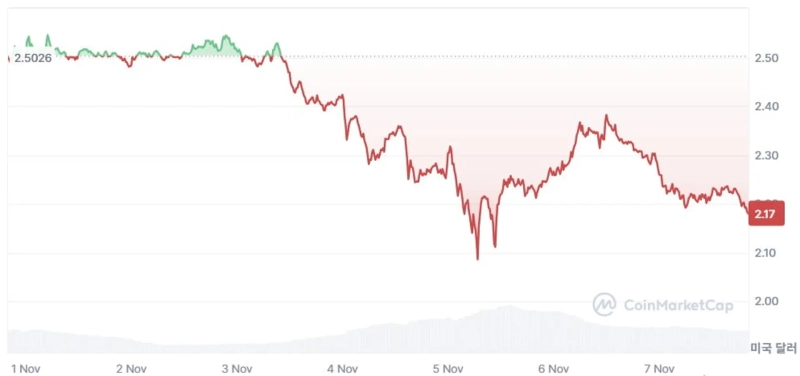

XRP did not escape this week's downturn but performed relatively well. At one point the $2 level was threatened, but it has slightly rebounded and is trading around $2.17–$2.20 on CoinMarketCap.

Although overall market sentiment was poor, on-chain indicators were rather positive. This appears to have helped XRP defend its price. According to TradingView, XRP's price fell over the past month, but its market share (dominance) rose from 3.8% to 4% in the same period. CryptoQuant's data shows the 30-day average of XRP withdrawal addresses from exchanges increased from under 1,000 to over 2,500. This is interpreted as investors returning to long-term holding rather than selling. New XRP wallets increased by 21,595 over the past two days, marking the largest increase in eight months. This suggests network activity and the user base are expanding again.

The most notable news this week was Ripple's collaboration with Mastercard. On the 5th, Ripple announced it is conducting card payment settlement tests on the XRP Ledger using the stablecoin Ripple Dollar (RLUSD) together with Mastercard, WebBank, and Gemini. Market attention focused on Ripple's move to become a global payment infrastructure company. Following the news, XRP briefly rallied about 5%.

In the short term, $2.30 is expected to be a key pivot. It is currently trading below this level, so short-term adjustments may continue. FXStreet predicted, "If it falls below $2.3, a correction to $1.9 could follow." Crypto specialist NewsBTC also said, "If it fails to break $2.30, $2.180 and $2.150 will act as the first supports," adding, "If these are breached, further declines to $2.00 or $1.85 are possible." Recovery above $2.30 will be important for a rebound.

Spotlight Coins

1. Humanity Protocol(H)

One of the most talked-about coins recently was Humanity Protocol. It surged more than 100% over the past month. However, it has given back most gains and is trading at $0.1189 on CoinMarketCap.

Humanity Protocol is a 'decentralized identity (DID)' project. Its core is enabling users to prove they are a 'real person' without revealing personal information. Unlike existing methods where identity is stored on government or corporate servers, individuals store their identity information in a DID wallet and selectively disclose only the information needed. For example, when verifying age, only the fact of being an adult is disclosed rather than the full birthdate.

This approach can be implemented using 'zero-knowledge proof (ZK)' technology. Users verify they are human in the Humanity app via a palm scan, and biometric data is not stored on a central server but converted into an encrypted code used only on the smartphone.

On the 5th, it drew attention with news of a partnership with Mastercard. Through this collaboration, Mastercard's open finance technology will be integrated with Humanity Protocol's 'HumanID.' HumanID holders will be able to quickly verify financial information such as credit, loans, and asset history without submitting supporting documents.

However, the price plunged immediately after the partnership announcement. The price of Humanity Protocol, which had surged 110% in October, fell more than 60% in one day after the partnership was announced. It was a typical 'buy the rumor, sell the news' pattern. Nonetheless, given growing global interest in decentralized identity (DID) and AI trust infrastructure, the project's medium- to long-term growth potential is still considered valid.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)