"Bitcoin's recent correction: little impact from ETFs… whale sell-offs had greater effect"

Summary

- Analysts say the main cause of Bitcoin's correction was not net outflows from spot ETFs but whale sell-offs.

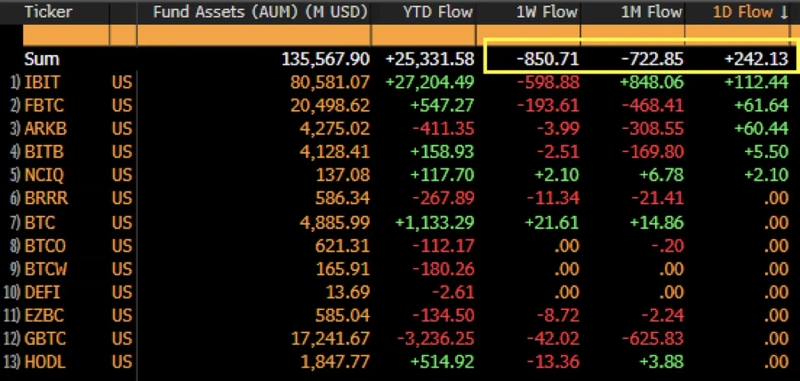

- A Bloomberg ETF analyst said recent one-month ETF net outflows amounted to about $722 million.

- Over the past month, long-term holders reportedly sold about 400,000 BTC (about $45 billion).

Analysts say Bitcoin's recent correction was caused by whale sell-offs rather than net outflows from spot exchange-traded funds (ETFs).

On the 7th (local time), Eric Balchunas, a Bloomberg ETF analyst, said, "Even as Bitcoin fell 20%, net withdrawals from spot ETFs amounted to less than $1 billion. Net outflows over the past month totaled about $722 million."

He added, "Baby boomer investors who use ETFs are by no means insignificant," and said, "So who sold? To borrow a line from a horror movie, 'the phone was ringing inside the house.'"

His remarks are interpreted as pointing out that in mid-October Bitcoin whales and long-term holders carried out large sell-offs near $100,000. In fact, according to 10X Research data, long-term holders sold about 400,000 BTC (about $45 billion) over the past month.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)