126% surge after hack…"Why 'now is the coin surge moment' is causing an uproar"

Summary

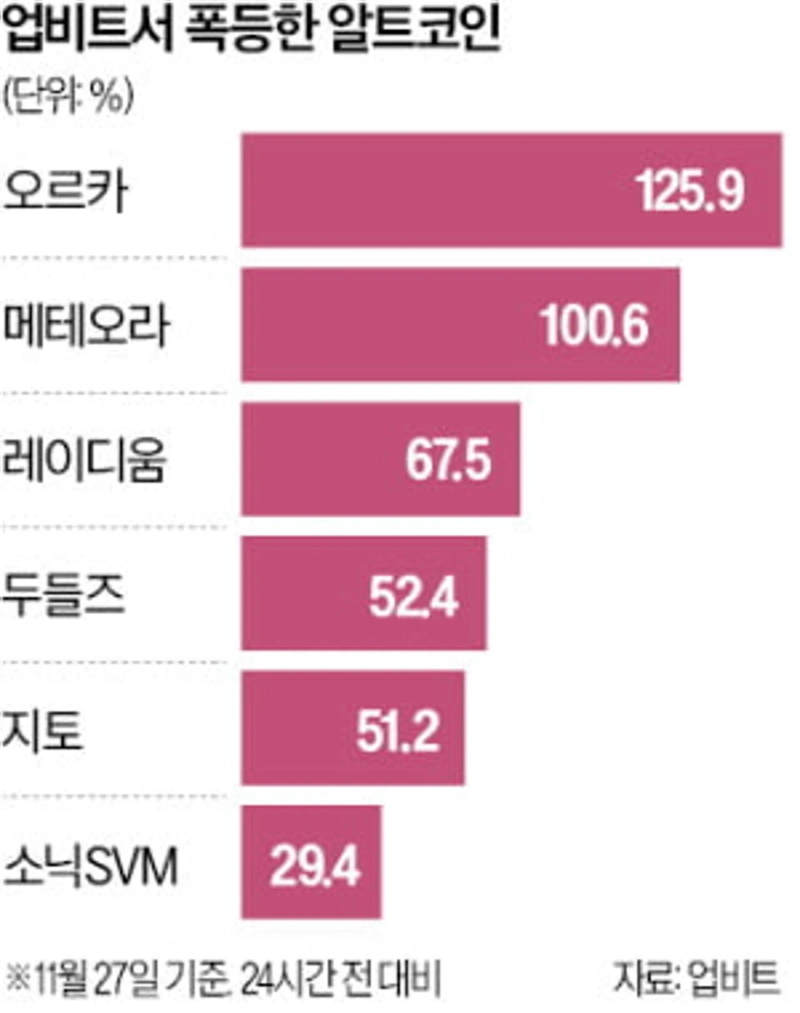

- It reported that altcoin prices on Upbit surged 126% following a hacking incident, showing an overheating trend.

- It stated that suspension of deposits and withdrawals blocked arbitrage, so price gaps were not resolved and speculative trading and price manipulation became easier.

- It reported that trading volume surged, increasing Upbit's fee revenue, and that calls for investor protection measures were raised.

Altcoins surge 126% after hack

The paradox of Upbit 'deposit and withdrawal suspension'

Coin transfers blocked, profits from arbitrage impossible

Price spikes do not get resolved even if sudden

Orca trading volume, up 100,000,000 in one day

Upbit pockets fees in the middle

Some call for "investor protection measures"

At South Korea's largest cryptocurrency exchange Upbit, a "strange" overheating phenomenon has appeared centered on altcoins (virtual assets other than Bitcoin). Because deposits and withdrawals were suspended to handle a hacking incident, arbitrage that narrows price gaps was blocked. Speculative trading aiming for rapid price rises became easier, and there are criticisms that Upbit — which suffered the security incident — is actually earning a considerable amount in fees.

According to the crypto industry on the 28th, Upbit suffered a hacking attack on the morning of the 27th and subsequently suspended deposits and withdrawals for all cryptocurrencies. After that, altcoin prices such as Orca, Meteora, and Zito surged. Zito at one point traded on Upbit at prices more than 35% higher than global rates.

This happened because Upbit suspended deposits and withdrawals to investigate the hacking incident and perform security checks. An exchange may block deposits and withdrawals after reporting to the Financial Services Commission if there are legitimate reasons such as a hack. Under normal circumstances, when prices rise, arbitrage occurs by bringing cheaper virtual assets from other exchanges to sell, which balances prices. If deposits and withdrawals are suspended, trading occurs only within Upbit, so price spikes are not resolved.

As a result, it is easier for certain forces to manipulate prices, analysts say. The market calls this "caged pumping." It means artificially driving up the price within a limited circulating supply, like keeping fish in a cage. In some coin communities there were even posts encouraging speculation, saying, "A cage is expected for over a month. Now is the moment for a surge."

In this process, there are also criticisms that Upbit is significantly increasing its fee revenue. Upbit charges a 0.05% fee on the transaction amount when buying and selling. Despite causing a security incident, the increased volatility boosted trading volume and created a distorted structure in which revenues rise.

Orca, which had almost no trading volume just before the hack, saw trading volume explode to 100,000,000 units the previous day. Using a simple calculation based on Orca's 24-hour trading value (about 330,000,000,000 won) as of 3 p.m. that day, it is estimated that Upbit collected 160,000,000 won in fees in a single day. An industry source said, "Not only Orca but many cryptocurrencies have seen abnormal surges in trading. The longer the deposit and withdrawal suspension lasts, the more Upbit's fee income from speculative trading will increase."

There are also calls for investor protection measures that temporarily suspend the service itself beyond simple blocking of deposits and withdrawals when a hacking incident occurs. Even if a hack cannot be technically prevented 100%, the structure in which an exchange profits from the incident should be improved. Currently the law focuses only on compensating for losses. However, it is pointed out that investors are unlikely to be compensated for losses incurred in the process of normalizing trading.

Reporter Jo Mi-hyun mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)