Editor's PiCK

Fear of Bitcoin decline persists… institutions' 'spot ETF' selling continues

Summary

- Expectations of a U.S. rate cut have formed and investor sentiment for Bitcoin has somewhat recovered.

- However, institutional investors' selling of spot ETFs continues, causing large net capital outflows from the market.

- Experts say support at the ₩130,000,000 level will be an important first test for the future direction of Bitcoin prices.

Amid expectations of a U.S. rate cut

Price pause after a month-long decline

Support at the ₩130,000,000 level is a variable

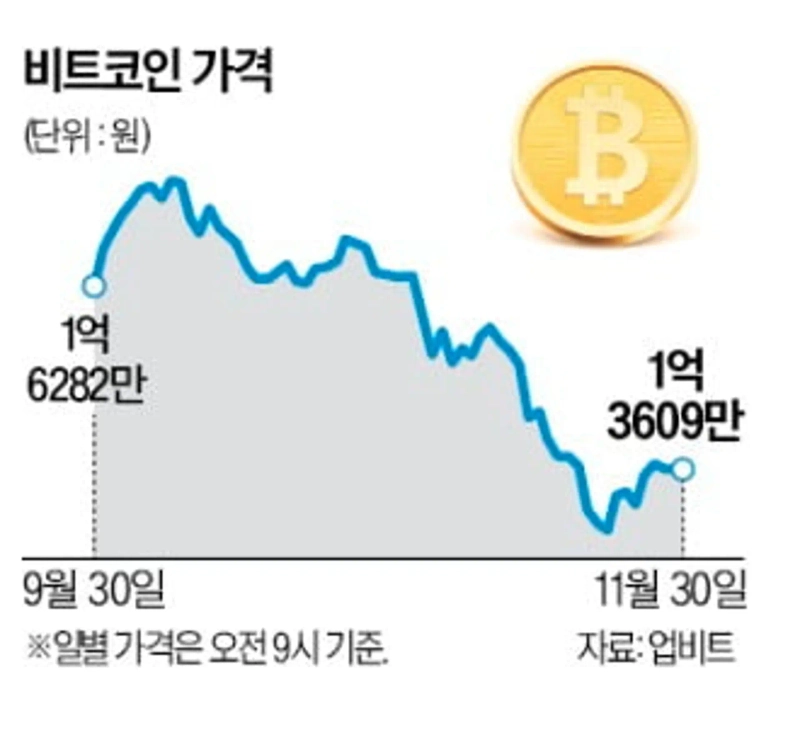

Bitcoin prices, which had been falling repeatedly for about a month, appear to have recently rebounded. The view is that renewed expectations that the U.S. benchmark interest rate could be cut have somewhat restored investor sentiment. However, many say it is too early to be reassured because the downtrend has only just stopped. Institutional investors' selling has continued to drain large amounts of money from the Bitcoin spot exchange-traded fund (ETF) market. How well the ₩130,000,000 level is held is expected to be the first hurdle that will determine Bitcoin's future price direction.

◇Price slide halted by U.S. rate cut hopes

Fear of Bitcoin decline persists… institutions' 'spot ETF' selling continues. On the 2nd, according to domestic crypto exchange Upbit, Bitcoin was trading at ₩136,097,000 at 9 a.m. on the 30th of last month. It has risen for more than a week, partially recovering some of the losses from the previous month's decline. Overseas, it also reclaimed the $90,000 level.

Bitcoin's price plunged sharply after its record high on October 9 (₩179,870,000) and at one point fell to around ₩121,000,000 on the 22nd of last month. It dropped more than 30% over 44 days, returning to April levels.

The view is that renewed expectations that the U.S. benchmark interest rate could be cut have somewhat recovered investor sentiment. The U.S. central bank (Fed) released the Beige Book on the 26th of last month (local time), saying employment is slightly declining while inflation is rising moderately. The Beige Book is an economic summary report the Fed publishes eight times a year that summarizes regional economic conditions across the United States.

The Fed said, "Although layoff notices have increased in some areas, many firms are adjusting their workforces by avoiding direct layoffs through hiring freezes and natural attrition." On inflation, it also noted, "Pressure from tariffs and rising input costs persists in manufacturing and distribution."

This content of the Beige Book is seen as further stoking expectations that the Fed could cut rates soon. In U.S. financial markets, New York Federal Reserve Bank President John Williams said at an event hosted by the Chilean central bank on the 21st of last month that "the Fed has room to lower the benchmark rate in the near term," which had already strengthened views anticipating a rate cut. Just before this remark, the local market had placed the probability of a 0.25% point cut in the U.S. benchmark rate in December at 30%, but that probability has since jumped to about 80%. As rates fall, there tends to be stronger preference for risky assets such as stocks and Bitcoin.

◇Continued institutional selling… $3.69bn net outflow from ETFs alone

Although Bitcoin's price has rebounded slightly, the financial market is not easily optimistic that the uptrend will continue. Institutional investors and corporations have been selling Bitcoin spot exchange-traded funds (ETFs) one after another. According to ETF.com, from the 1st to the 24th of last month, the 11 Bitcoin spot ETFs listed on the U.S. stock market saw net outflows of about $3,687,900,000 (about ₩5,392,800,000,000). This set a new record, surpassing the $3,560,400,000 net outflow in February when Bitcoin fell 22%.

Among Bitcoin spot ETFs, the largest by net assets, the iShares Bitcoin Trust (IBIT), saw $2,350,000,000 flow out during the period. Large amounts of funds also flowed out of Fidelity Wise Origin Bitcoin (FBTC·$654,940,000) and ARK 21Shares Bitcoin (ARKB·$231,580,000).

Bitcoin spot ETFs, first launched in the U.S. in January last year, have become one pillar affecting Bitcoin prices by attracting large institutional investments.

Marcus Thielen, CEO of 10X Research, diagnosed, "Large net outflows in the Bitcoin spot ETF market mean institutions are choosing not to inject new funds to buy Bitcoin," adding, "As long as their selling continues, it will be difficult for Bitcoin prices to rebound."

The record forced liquidation on October 10 also left lingering fear among crypto investors. On that day alone, $19,156,000,000 (about ₩27,400,000,000,000) worth of positions were forcibly liquidated in the cryptocurrency futures market. Multiple adverse factors piled up after that incident, prolonging Bitcoin's downtrend. The so-called 'Uptober' superstition that Bitcoin prices rise every October was shattered for the first time in seven years.

Experts say that whether Bitcoin can hold above $90,000 (₩132,000,000) will be the first test. Crypto analyst Skew said, "Bitcoin is now moving in the $90,000–$92,000 range, a phase that will decide the medium-term trend," adding, "If the $88,000 level breaks, the attempt to rebound should be considered a failure."

Reporter Jinseong Kim jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)