Summary

- According to the AI-based Web3 search platform Kaito, the virtual assets drawing the most investor attention currently are Ethereum (ETH), DeFi App (HOME), and Arbitrum (ARB).

- The asset management firm Bernstein recently said that companies are actively purchasing Ethereum, but various risks such as liquidity and smart contracts should be taken into account.

- Arbitrum (ARB) fell by about 7% intraday, causing concern among investors, while upcoming token launches for Succinct (SUCCINCT) and Monad (MON) also drew significant interest.

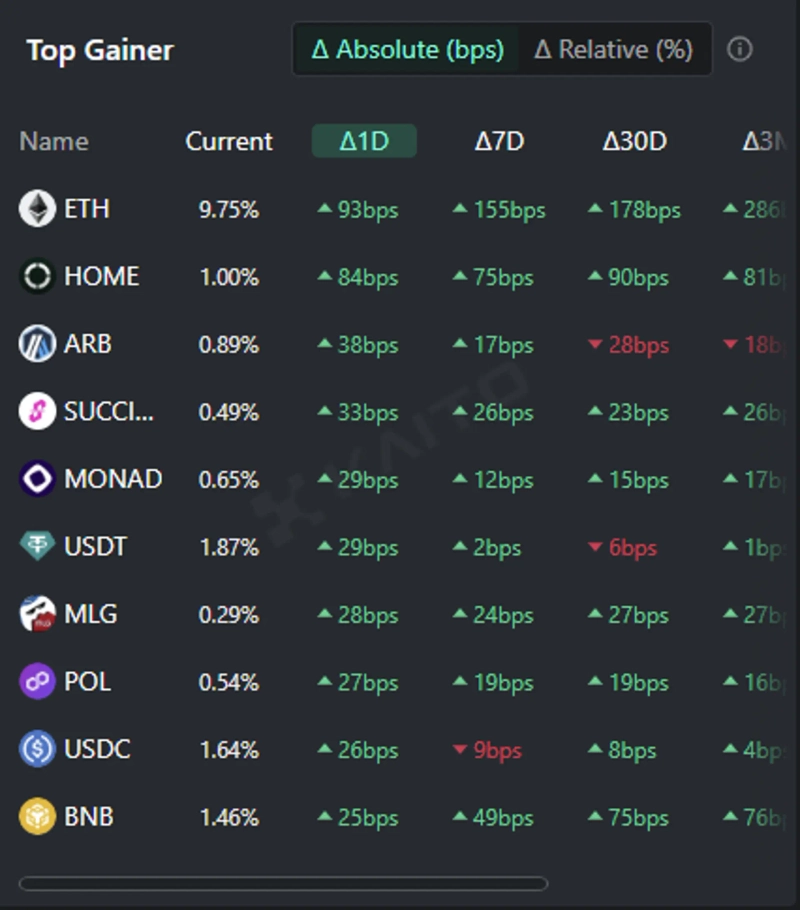

According to Token Mindshare, the indicator for quantifying the influence of specific tokens in the virtual asset market on the AI-based Web3 search platform Kaito, as of the 29th, the top 5 virtual asset-related keywords drawing the most attention are Ethereum (ETH), DeFi App (HOME), Arbitrum (ARB), Succinct (SUCCINCT), and Monad (MON).

Ethereum ranked first, continuing its lead from the previous day. The asset management firm Bernstein stated in its report, "Recently, companies have been actively purchasing Ethereum," but also diagnosed that "it is necessary to take into account various risks such as liquidity and smart contracts." According to the report, since July, companies have purchased about 876,000 Ethereum, nearly 1% of the total supply.

DeFi App came in second. The Yapping event by DeFi App and Kaito, which started the previous day, attracted the attention of investors.

Arbitrum took third place. Arbitrum plummeted by around 7% intraday, causing concerns among investors. As of 1:14 p.m., Arbitrum was trading at $0.433, down 6.34% from the previous day according to CoinMarketCap.

Succinct and Monad, both of which are scheduled for token launches soon, ranked fourth and fifth, respectively. In particular, Succinct received significant attention after opening its airdrop page on this day.

In addition, investors were also interested in Tether (USDT), MLG, Polygon (POL), USDC, Binance Coin (BNB), and others.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.