Despite GENIUS Act’s ‘Interest Payment Ban’…Coinbase and PayPal Maintain Stance: ‘Rewards Are Separate’

Summary

- Regarding the 'interest payment ban' clause of the GENIUS Act, Coinbase and PayPal said they will continue their reward programs.

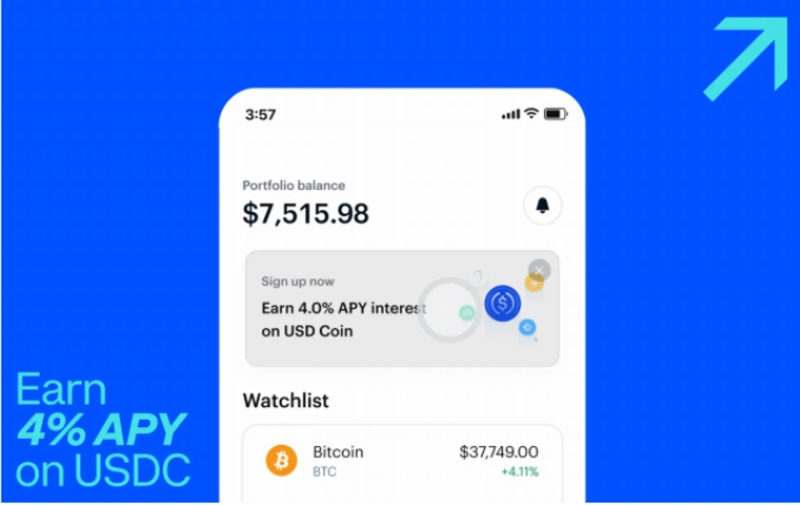

- Currently, Coinbase offers a 4.1% annual reward to USDC holders, while PayPal provides a 3.7% reward to PYUSD holders.

- The law’s interest payment ban is limited to ‘issuers’, and reward programs in the secondary market are not within its regulatory scope.

There is ongoing debate over the interpretation of the 'interest payment ban for issuers' clause included in the GENIUS Act, the US regulation for stablecoins (virtual assets pegged to fiat currency).

On the 4th (local time), Decrypt, a cryptocurrency-focused media outlet, reported that crypto exchanges Coinbase and PayPal stated they plan to continue offering 'reward programs' to stablecoin holders.

Currently, Coinbase provides an annual yield of 4.1% to USDC users in the US, while PayPal offers an annual reward of 3.7% to PYUSD users.

Brian Armstrong, CEO of Coinbase, maintained that Coinbase’s ‘rewards’ program does not fall under the GENIUS Act. He emphasized, “The GENIUS Act regulates issuers, and Coinbase is not an issuer,” adding, “What we provide is not interest, but rewards.”

In fact, the issuer of USDC is Circle. Coinbase, through a contract with Circle, distributes USDC on its platform and develops business strategies, but does not act as an issuer. Likewise, PayPal is not the issuer of PYUSD; all issuance is handled by Paxos.

One official explained, “The GENIUS Act aims to define stablecoins as a means of payment, not deposit products,” and stated, “The interest payment ban is limited to issuers.” They added, “Reward programs in the secondary market fall outside the scope of this law and require separate discussion.”

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.