Editor's PiCK

[Analysis] "Bitcoin enters 'air-gap'... Possibility of additional selling pressure"

Summary

- Glassnode stated that the price of Bitcoin has entered a low-liquidity air-gap zone.

- It was reported that if the market fails to recover its major resistance levels, the likelihood of an adjustment down to around $110,000 may increase.

- Although the profitability of short-term investors has decreased, it was analyzed that additional selling pressure may arise if demand does not recover quickly.

There is an analysis that the price of Bitcoin (BTC) has entered a low-liquidity 'air-gap' zone. If price increases do not materialize, there is also the view that additional selling pressure may occur.

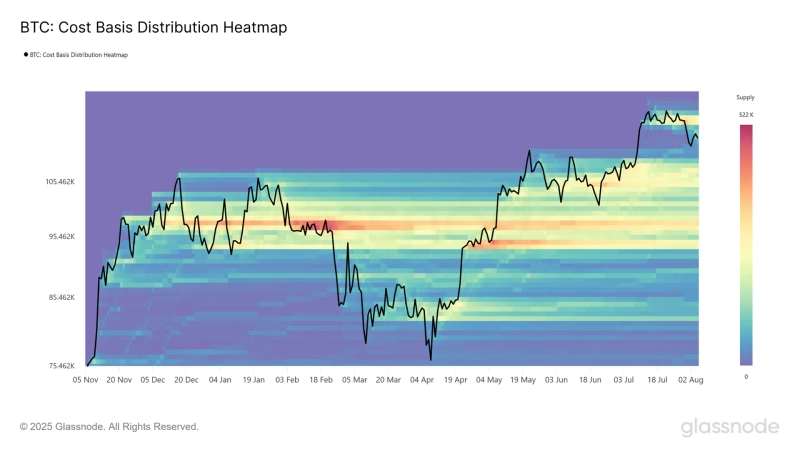

On-chain analytics firm Glassnode stated in its weekly report on the 6th (local time), "After Bitcoin set a new all-time high last month, its price fell below $116,000 and entered a low-liquidity air-gap." It added, "The market has not yet recovered its key resistance levels." Glassnode said, "The current resistance is around $116,900," and added, "If Bitcoin remains below this level for an extended period, the likelihood of an adjustment down to the lower bound of the air-gap near $110,000 increases."

The profitability of short-term investors was also mentioned. Glassnode noted, "Short-term investor profitability has decreased, but about 70% of the supply still remains in profit," and added, "Some indicators for the short-term holder base are consistent with typical bull market trends." It continued, "(However) if demand does not recover quickly, the confidence of new investors may weaken, leading to additional selling pressure."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)