Summary

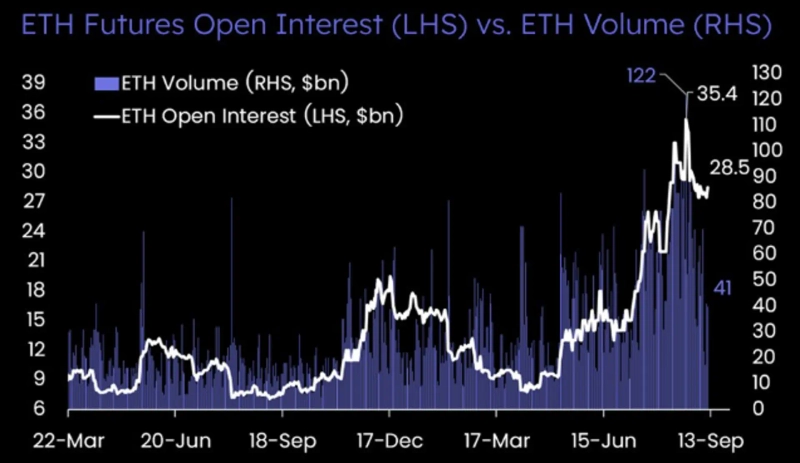

- "Matrixport said Ethereum (ETH) spot trading volume fell sharply from $122 billion to $41 billion."

- "The drop in spot trading volume could lead some traders to unwind leveraged long positions."

- "It explained that the net asset value (NAV) of Ethereum reserve firms is approaching 1, meaning investors are not paying a premium."

Analysis suggested that traders of Ethereum (ETH) perpetual futures may unwind leveraged long positions.

On the 10th (local time), Matrixport said in a report, "This week Ethereum spot trading volume fell sharply from $122 billion to $41 billion," while "Ethereum futures open interest (OI) remains at a high level." It added, "As spot trading volume declines, some traders may unwind Ethereum leveraged long positions."

It also said the value of Ethereum reserve firms is declining. Matrixport elaborated, "The net asset value (NAV) of Ethereum reserve firms is close to 1," noting, "This means investors are not paying a premium for those shares."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)