Editor's PiCK

[Analysis] "Bitcoin, long-term holders' NUPL rebounds compared to September… trend turns upward"

Summary

- Analysis says Bitcoin has shifted to an upward trend since September on on-chain data.

- The long-term holders' NUPL indicator entered the unrealized profit zone, and the market price is above the realized price.

- It said that if trading continues above $120,000, institutional buying pressure may strengthen.

Bitcoin has been analyzed to have shifted to an upward trend after a third-quarter correction on on-chain data.

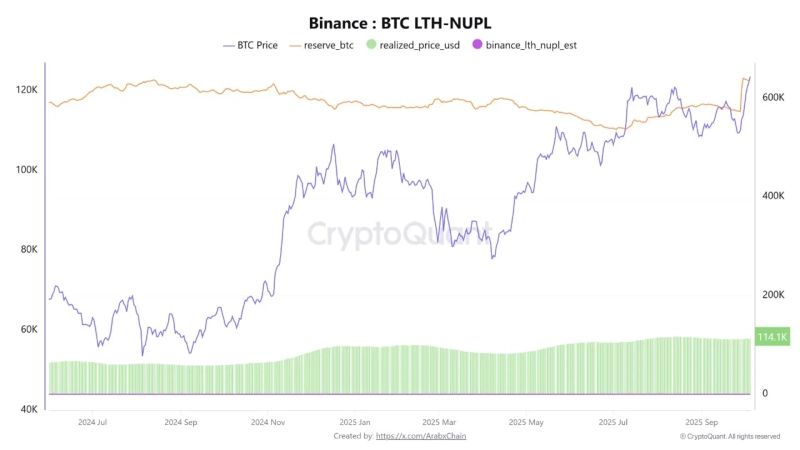

On the 6th (local time), CryptoQuant author Arab Chain said, "The long-term holders' NUPL (Net Unrealized Profit/Loss) indicator for Bitcoin (BTC) recorded 0.0728, entering approximately a 7.3% unrealized profit zone. This is a rebound from the negative area at the end of September and suggests that Bitcoin's price has returned to an upward trend after the third-quarter correction."

He added, "The current Realized Price is approximately $114,582, and the spot price is $123,577, so the market price is about $9,000 above the realized price. This indicates the market has entered a stable upward phase. If the market price remains above the realized price, the medium-term uptrend will continue. In particular, if the long-term holders' NUPL surpasses 0.10, it would confirm entry into a structural expansion phase, and if trading continues above $120,000, institutional buying pressure is likely to noticeably strengthen."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)