Summary

- "JPYC" is expected to grow as the stablecoin market and Japan's digital transformation intersect.

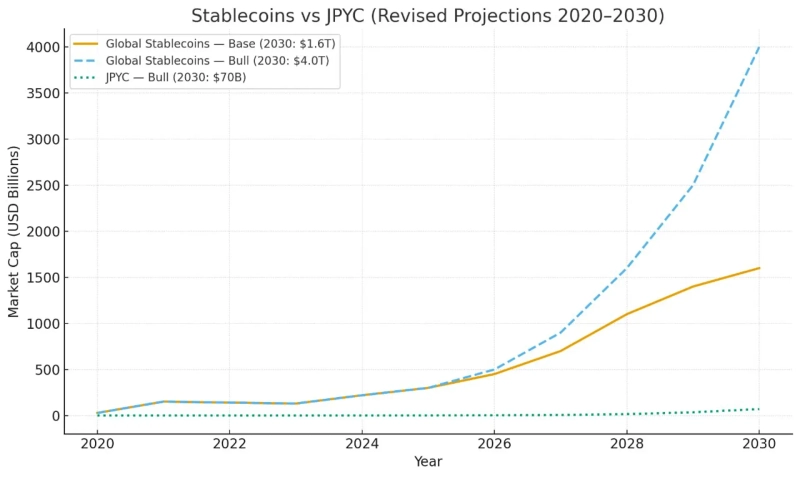

- The contributor said JPYC could grow to $70 billion by 2030.

- "JPYC" complies with Japan's Payment Services Act, is fully collateralized, and has various use cases such as real-time payments, salary payments, and peer-to-peer transfers.

An analysis has emerged that JPYC, Japan's yen-pegged stablecoin (a virtual asset whose value is linked to fiat currency), could grow into a global digital currency by 2030.

On the 9th (Korea time), CryptoQuant contributor 'XWIN RESEARCH JAPAN' said, 'JPYC stands at the intersection of the rapidly growing stablecoin market and Japan's digital transformation,' and analyzed that 'considering the growth rate of the stablecoin market, JPYC could grow to $70 billion by 2030.'

The contributor said, 'Large financial institutions such as Citi and Bloomberg expect the stablecoin market to grow to between $1.6 trillion and $4 trillion by 2030,' and explained, 'JPYC complies with Japan's revised 'Payment Services Act' and is fully collateralized. JPYC could become Asia's representative digital yen.'

Meanwhile, the contributor cited JPYC's use cases as real-time payments, salary payments, and peer-to-peer transfers.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)