Summary

- "It reported that a Bitcoin rally could occur due to dollar weakness."

- "It stated that ongoing fiscal deficits and structural inflation are increasing demand for non-sovereign assets."

- "It reported that Bitcoin and other virtual assets are establishing themselves as an investment alternative and hedge outside the dollar-centric system."

An analysis said a Bitcoin (BTC) rally could arrive due to dollar weakness.

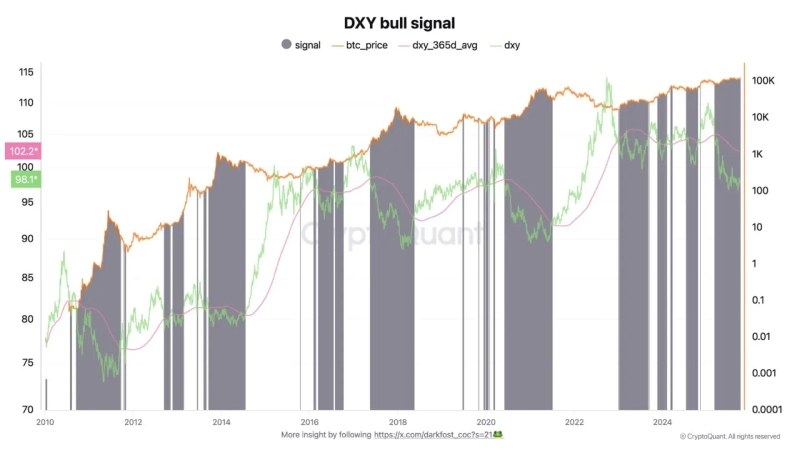

On the 9th (Korea time), CryptoQuant contributor DarkPost said, "The dollar index (DXY) is currently trading below the annual average line (about 100 points) for the 220th day," and "During the same period, Bitcoin rose from about $86,000 to over $125,000."

The contributor explained, "When the dollar is weak, capital tends to move to assets that are a store of value or have growth opportunities," and "Although there is a certain lag in this correlation, overall it has worked very well for Bitcoin."

They added, "Beyond short-term price fluctuations, this trend is likely to strengthen over time," and "As ongoing fiscal deficits and structural inflation weaken confidence in traditional economies, demand for non-sovereign assets continues to grow."

Finally, "Bitcoin and other virtual assets (cryptocurrencies) potentially function as a hedge against this flow," they added, "and are establishing themselves as an alternative to invest outside the dollar-centric system and existing fiat currencies."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)