Etena amid depegging incident…"USDe collateral ratio actually rises…all functions operating normally"

Summary

- Etena said that despite the USDe depegging incident, issuance and redemption functions operated normally.

- USDe is currently maintaining an overcollateralised state, and its collateral ratio has risen compared to the previous day, it said.

- Etena said that the short position related to perpetual futures price movements will lead to protocol revenue.

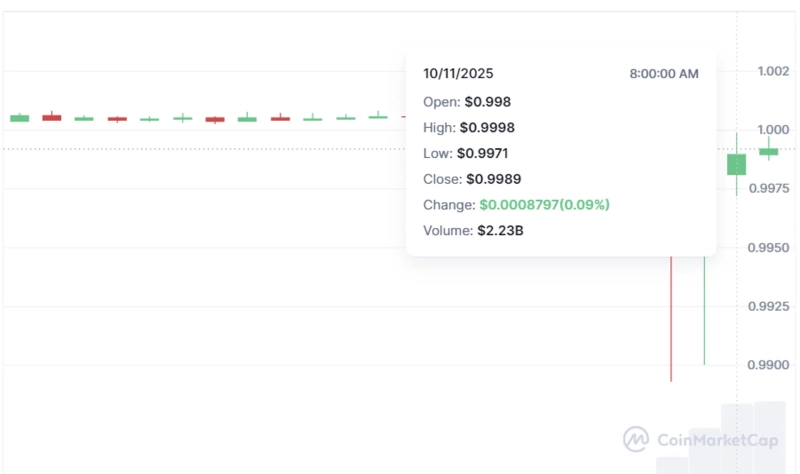

Etena (ENA) updated the current situation regarding the depegging incident of the stablecoin USDe.

On the 11th (local time), Etena said via X, "USDe experienced temporary price fluctuations due to market volatility and increased liquidations, but issuance and redemption functions continued to operate normally without interruption," and explained that "USDe is still in an overcollateralised state."

Also, "Due to liquidations, perpetual futures prices are trading below spot, and Etena holds a short in that position, so this fluctuation will translate into protocol revenue. Accordingly, USDe's collateral ratio is expected to be higher than the previous day," it said.

Etena will provide additional updates as the situation stabilizes.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)