Editor's PiCK

Record liquidation event due to Trump tariff fallout… $19 billion vanished in 12 hours

Summary

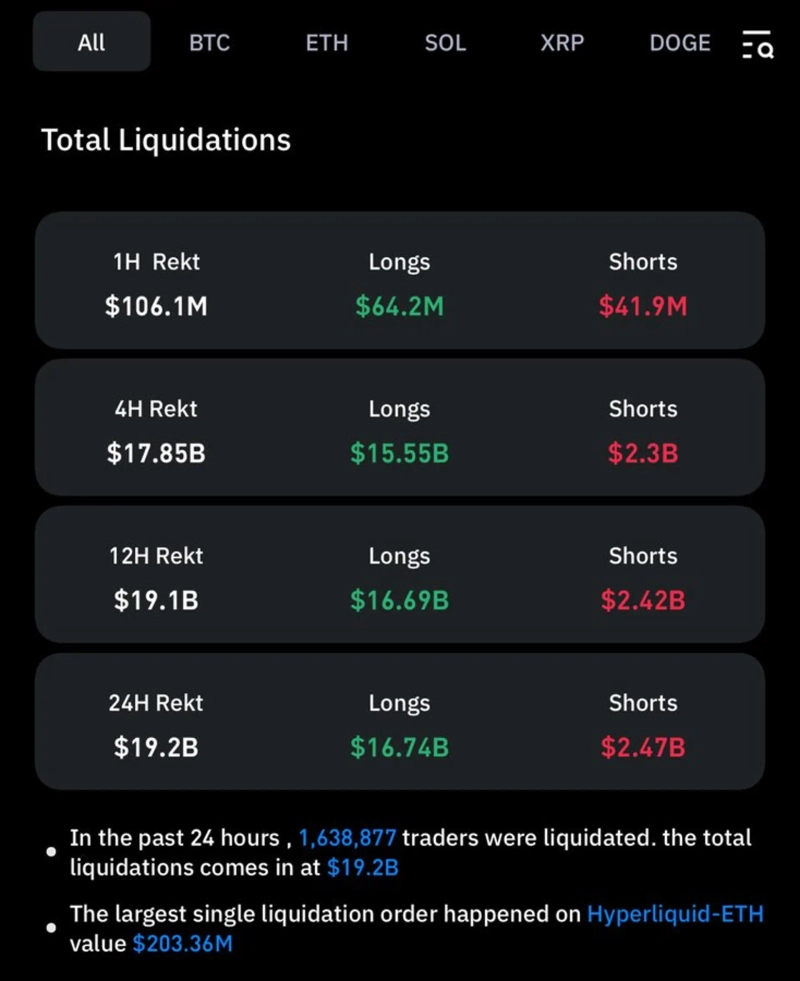

- It reported that the virtual asset market experienced the largest-ever liquidation event due to the Trump tariff fallout.

- They said that positions worth a total of $19 billion were liquidated in 12 hours, and some altcoins fell more than 90%.

- Coinglass analyzed that the actual total liquidation size could reach up to $40 billion, and that this would be the largest liquidation event in virtual asset history.

This morning's crash in the virtual asset (cryptocurrency) market triggered the largest liquidation event in history.

On the 11th (local time), according to Coinglass data cited by Solana Floor, the crash caused a total of 1.6 million traders to lose positions, and $19 billion (about 27 trillion won) in positions were liquidated in 12 hours.

Some altcoins were shown to have plunged more than 90%. By exchange, Hyperliquid(Hyperliquid) saw $10 billion in liquidations, Bybit(Bybit) $4.5 billion, and Binance(Binance) $2.5 billion.

On-chain, roughly $400 million in positions were liquidated on the Solana (SOL) network alone, and the total liquidation amounted to $2 billion over 12 hours.

Coinglass analyzed, "The actual total liquidation size could be $30 billion to $40 billion," and "this event will be recorded as the largest liquidation event in virtual asset history."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)