Summary

- Larry Fink, BlackRock CEO, said Bitcoin can be a great alternative investment like gold.

- He said he is positive from the perspective of diversification, but that it should not make up a large share of a portfolio.

- BlackRock's Bitcoin spot ETF IBIT has currently recorded $93.9 billion in assets under management, and is on the verge of surpassing $100 billion in the shortest period.

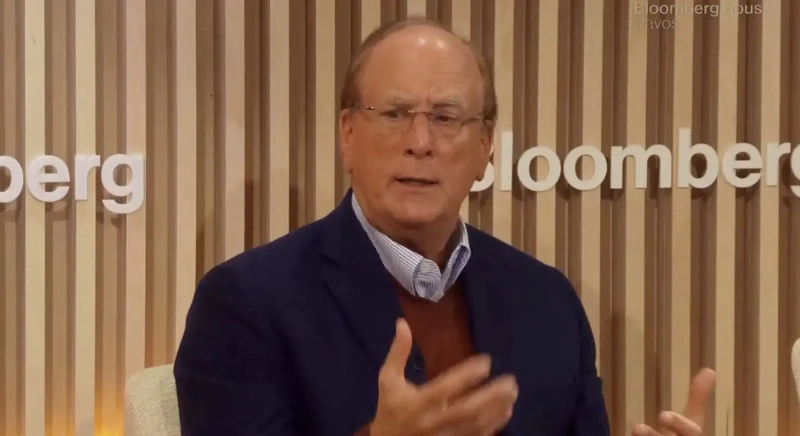

Larry Fink, BlackRock chief executive officer (CEO), expressed a positive view on Bitcoin (BTC).

On the 14th (Korean time), according to Decrypt, a virtual asset (cryptocurrency) news outlet, CEO Fink said in a CBS interview, "I have come to rethink my past remarks that Bitcoin was an indicator of criminal money laundering," and "virtual assets have a role as alternative assets, like gold." He added, however, "I think it's not bad for diversification, but it should not make up a large share of a portfolio."

BlackRock currently manages the largest amount of funds in the spot exchange-traded fund (ETF) market for Bitcoin and Ethereum (ETH). BlackRock's Bitcoin spot ETF, IBIT, has recorded $93.9 billion in assets under management and is on the verge of surpassing $100 billion in assets under management in the shortest period on record.

In an investor letter earlier this year, CEO Fink stated, "Half of the demand for Bitcoin ETFs comes from retail investors, and three quarters of those were investors buying iShares products for the first time."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)