Summary

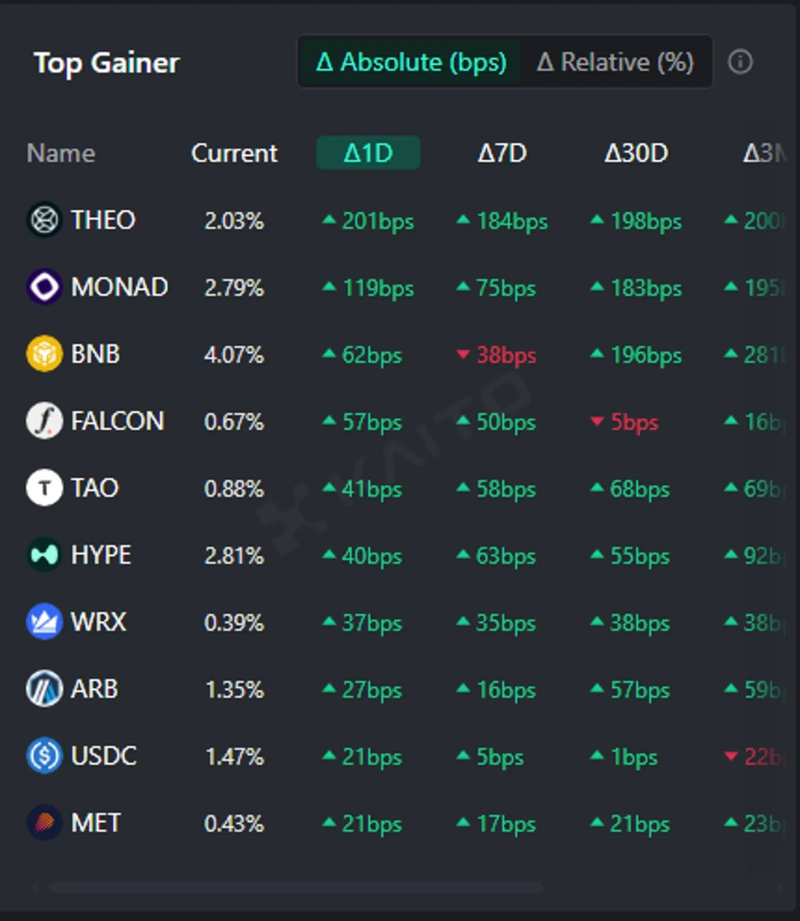

- Based on Kaito's Token Mindshare, THEO, Monad, Binance Coin were among the top five assets capturing investor interest.

- Kaito announced the release of THEO's leaderboard and that 0.05% of THEO's supply was allocated to the campaign.

- Bitensor drew investor expectations on news that Grayscale had filed paperwork to launch a trust product.

According to Token Mindshare (a metric that quantifies the influence of specific tokens in the virtual asset (cryptocurrency) market) of Kaito, an AI-based Web3 search platform, as of the 14th the top five virtual asset-related keywords that people are most interested in are THEO (THEO), Monad (MON), Binance Coin (BNB), Falcon Finance (FALCON), and Bitensor (TAO).

THEO drew investor interest after being newly added to Kaito. Kaito announced on X (formerly Twitter), "THEO's leaderboard has been released," and "0.05% of THEO's supply has been allocated to this campaign."

Monad took second place. Continued interest in airdrop claims is interpreted as the reason it remained in second place following the previous day.

Binance Coin ranked third. In connection with this crash, public opinion blaming Binance has continued to emerge, particularly within the community. The day before, Jeff Yen, founder of Hyperliquid, pointed out, "Some exchanges like Binance report only one case even when thousands of liquidations occur." Separately, Binance completed investor compensation totaling US$283 million for the USDe de-pegging incident. Changpeng Zhao, Binance founder, emphasized, "Instead of others avoiding responsibility or attacking competitors, we have a different value system that prioritizes user protection."

Falcon Finance took fourth place. It appears to have attracted investors' attention after recording intraday gains in the 14% range that day.

Bitensor took fifth place. News that digital asset manager Grayscale had filed paperwork to launch a Bitensor trust product raised investors' expectations. Grayscale said on X (formerly Twitter), "We have filed the foundational paperwork for a Bitensor trust product," adding, "This will serve as the first step toward converting to an SEC-reporting company and will help elevate accessibility, transparency, and regulatory status."

Investors also showed interest in Hyperliquid (HYPE), WazirX, Arbitrum (ARB), USDC, and Meteora (MET).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)