Editor's PiCK

Bitcoin plunges as US-China tensions reignite… Ethereum and Solana also weak [Lee Su-hyun's Coin Radar]

Summary

- The rekindling of US-China tensions led to a sharp drop in major crypto assets such as Bitcoin, Ethereum, and Solana.

- Ethereum held up relatively well due to institutional buying but faces potential further technical corrections, while Solana continued to decline due to slowing network activity and ETF review delays.

- AthenA experienced a loss of trust and a sharp price drop due to the USDe depegging incident; whether support levels hold and trust is restored will significantly impact investor sentiment going forward.

<Lee Su-hyun's Coin Radar> examines the flow of the crypto asset (cryptocurrency) market over the week and provides in-depth commentary on the background. Beyond simple price listings, it analyzes global economic issues and investor movements in three dimensions, offering insights that can gauge the market's direction.

Major coins

1. Bitcoin (BTC)

Bitcoin continued its decline throughout this week and fell below 110,000 dollars. As of the 17th, it is trading around 107,000 dollars on CoinMarketCap.

The biggest factor affecting the downturn was the rekindling of US-China tensions. On the 10th (local time), President Trump announced he would impose an additional 100% tariff in response to China's control of rare earth exports, which escalated tensions between the two countries.

Afterwards, President Trump softened his remarks and then returned to a tough stance, increasing market unease. On the previous day (the 16th), China's Ministry of Commerce took a hard line, saying "the cause of the conflict is the United States," and Bitcoin fell further to the 107,000-dollar level.

The market is currently watching whether a US-China meeting will be arranged at the APEC summit to be held in Korea at the end of this month. A summit meeting is likely to take place. Jamison Greer of the United States Trade Representative (USTR) said, "President Trump has cleared his schedule for a meeting with Chairman Xi Jinping," and China also stated, "We are ready to fight, but the door to dialogue is open."

Wall Street expects that if the two leaders meet at the APEC summit in Korea later this month, it is likely to shift to a ceasefire phase. In other words, Wall Street believes the recent sharp rhetoric from both sides is calculated behavior to strengthen negotiating positions.

Bitcoin is expected to undergo short-term correction for the time being. On-chain analysis firm Glassnode said, "If Bitcoin does not reclaim 117,100 dollars, the correction will continue." Since it has fallen below 110,000 dollars, avoiding further declines seems difficult.

However, some analysts say ETF inflows and dovish monetary policy are supporting the downside, so prices could recover toward the end of the year. Matt Mena, research strategist at 21Shares, said, "Over the past month, more than 6 billion dollars have flowed into US spot Bitcoin ETFs," adding, "With leveraged positions liquidated, short-term instability has decreased, and a gradual recovery toward the end of the year is likely."

2. Ethereum (ETH)

Ethereum fell by nearly 10% this week on CoinMarketCap but still held relatively well around the 4,000-dollar level. As of the 17th, it is trading around 3,800 dollars.

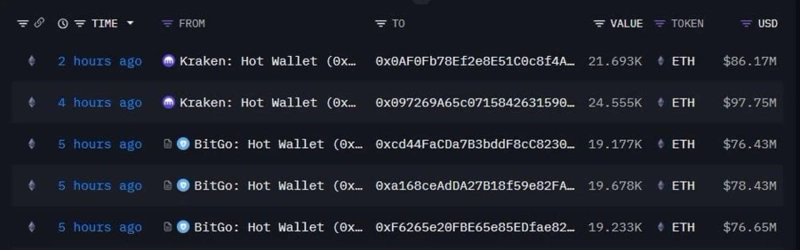

The main reason it held up in the bear market appears to be institutional buying. Bitmain added 202,037 Ethereum last week and this week bought an additional 26,199 on FalconX and 104,336 through BitGo and Kraken.

The scale amounts to about 520,000,000 dollars. According to a Bitwise report, of the 4.63 million Ethereum held by 27 listed companies, 95% were newly purchased in the third quarter of this year. Ultimately, this institutional accumulation is acting as a buttress for Ethereum.

However, there are technical signs of a downturn. Cointelegraph argued, "Ethereum shows a bearish pattern that has previously led to declines of up to 60%," raising the possibility of further adjustments. Technically, holding the 3,900-dollar support is important. Crypto asset analyst Ali Martinez predicted, "If the 3,900-dollar support holds, it could rise to 6,000 dollars, but if it loses that support, it could correct down to 2,800 dollars."

3. XRP (XRP)

XRP declined about 16% this week on CoinMarketCap, making it the largest decliner among major altcoins. As of the 17th, it is trading around 2.3 dollars.

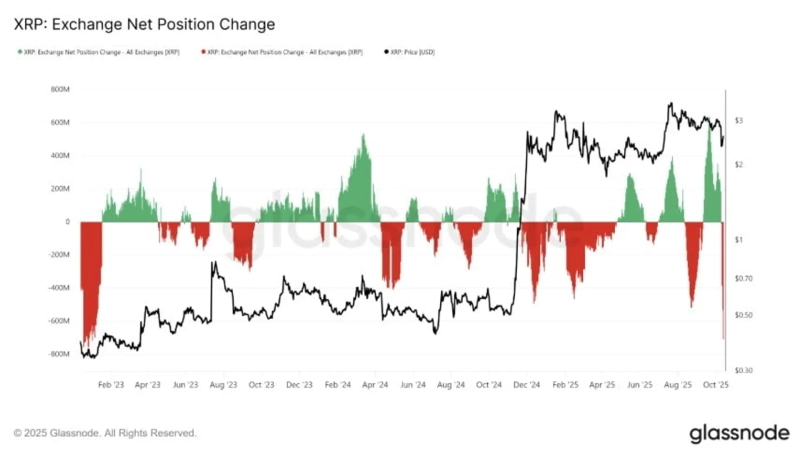

The decline was driven by massive whale sell-offs. According to BeInCrypto, addresses holding more than 100 million XRP sold 2.24 billion XRP since the 10th, amounting to about 5.4 billion dollars. Glassnode's exchange net position change data indicates this is the largest sell-off since December 2022.

Some view that XRP's bullish momentum has largely been exhausted. Glassnode diagnosed, "Investors who bought below 1 dollar have taken profits above 2 dollars, and most bullish energy has been expended."

However, this morning it was reported that issuer Ripple is planning a large-scale fundraising. Ripple plans to raise at least 1 billion dollars (about 1.419 trillion won) to establish an "XRP Digital Asset Treasury (DAT)." It is reported to be considering using a special purpose acquisition company (SPAC) for this.

If fundraising succeeds, it would be the largest XRP-based DAT. In the medium to long term, it is expected to have a positive impact on price stability.

But in the short term, the bearish trend is likely to continue because the key technical support at 2.45 dollars has been broken. Crypto-focused outlet CoinGape suggested XRP is showing bearish momentum and could fall further to 2 dollars.

Another crypto outlet, CryptoPotato, also said, "To avoid a bear market transition and return to an uptrend, reclaiming the 2.7-dollar level is necessary. If that is not achieved, it could fall to 1.25 dollars."

Coins in focus

**1. Solana (SOL)**n

Solana's weekly decline reached about 15% on CoinMarketCap, falling below 190 dollars. As of the 17th, it is trading around 181 dollars.

Recently, a slowdown in Solana network activity helped drive the decline. According to The Block, active addresses on the Solana network have steadily decreased in the third quarter of this year, peaking at 5.9 million on July 25 and currently down to 3.3 million. Messari reports that locked value (TVL) also fell 17% in the past week to 22.89 billion dollars.

Delays in the approval schedule for spot ETFs, previously seen as bullish, also affected price action. The US Securities and Exchange Commission (SEC) is currently reviewing filings from nine asset managers including Fidelity, Grayscale, and VanEck. Originally, Grayscale's Solana spot ETF decision should have come first on the 10th and then proceeded sequentially, but the review results were all delayed due to the US federal government shutdown.

Whale (large investor) moves have not been favorable either. According to on-chain analytics firm Nansen, Solana whales reduced their futures positions by as much as 103% last week.

In particular, large wallets holding more than 1 million dollars in Solana saw positions cut by more than 70%. Such large investors giving up additional buys and reducing holdings is seen as a signal of a short-term shift to a downturn, which could dampen market sentiment.

For now, the market focus is on ETF approval. Cointelegraph projected, "If ETF approval coincides with TVL recovery and increased DEX trading volume, Solana could rise to 300 dollars (around 430,000 won)." For the moment, reclaiming the 200-dollar resistance is important. Crypto analyst Lark Davis warned, "If it fails to break the 200-dollar resistance, it could be pushed down to 182 dollars, and if 175 dollars collapses, it could fall to 160 dollars."

2. AthenA (ENA)

AthenA also saw a significant drop this week. On CoinMarketCap, it plunged about 28% over the past seven days and, as of the 17th, is trading around 0.40 dollars.

The main cause was the depegging of AthenA's stablecoin USDe. On the 11th at 6:30 a.m. Korea time, USDe's price fell to 0.65 dollars on Binance, breaking its 1-dollar peg.

AthenA explained that it was a temporary phenomenon caused by a Binance oracle data error and that issuance and redemption were functioning normally, but the market shock was significant. Because USDe is the core stablecoin of the AthenA ecosystem, shaken trust directly affects the value of the AthenA token.

According to CoinDesk, AthenA's price plunged nearly 40% immediately after reports of the depegging. Traders Union analyzed that "if the 0.407-dollar support holds, a short-term rebound is possible," but others say rebound is difficult without trust restoration. Ultimately, this incident is likely to serve as a test of AthenA's long-term ability to restore confidence, beyond a simple price drop.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)