Editor's PiCK

U.S. spot Ethereum ETFs see net outflows for two consecutive trading days…$230.51 million flowed out on the previous day

Suehyeon Lee

Summary

- It reported that U.S. spot Ethereum (ETH) ETFs experienced a net outflow of $230.51 million on the previous day.

- Major ETF products such as BlackRock, Fidelity, Bitwise, and Grayscale all saw funds flow out, continuing net outflows for two consecutive trading days.

- Some products finished trading with no net inflows.

More than $200 million flowed out of U.S. spot exchange-traded funds (ETFs) for Ethereum (ETH) on the previous day.

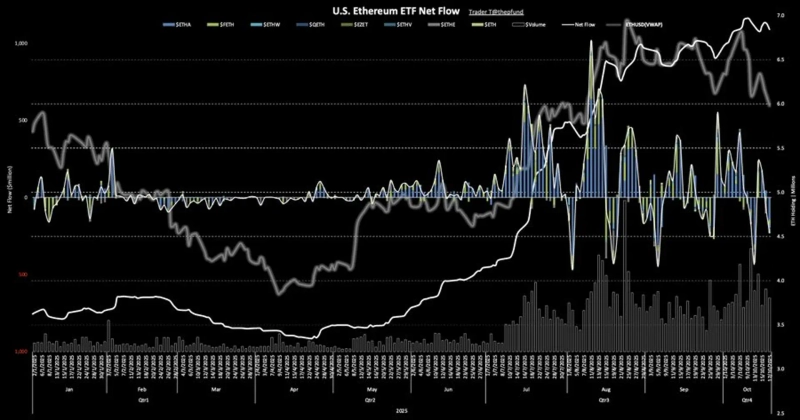

On the 18th (local time), according to TraderT, a total net outflow of $230.51 million (about 328.1 billion won) occurred from U.S. spot Ethereum ETFs on the previous day. This marks net outflows for two consecutive trading days.

On that day, BlackRock's ETHA had net outflows of $144.28 million, Fidelity's FETH had $30.61 million, and Bitwise's ETHW had $20.59 million. In addition, VanEck's ETHV recorded net outflows of $4.21 million, Grayscale's ETHE had $26.13 million, and Grayscale Mini ETH had net outflows of $4.69 million. The remaining products saw no net inflows or outflows.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)