Editor's PiCK

Mt. Gox to complete creditor repayments by the 31st of this month…"Market selling pressure is limited"

Summary

- It reported that Mt. Gox's Bitcoin (BTC) repayment deadline is approaching, raising the possibility of short-term selling pressure.

- The market said that inflows to exchanges during the repayment process are being dispersed, so selling pressure is expected to be limited.

- It said that while some of the unpaid bitcoins could move to exchanges in the short term, the possibility of a sharp price drop is limited.

The creditor repayment deadline for the Japanese exchange Mt. Gox, which experienced the largest cryptocurrency hacking incident in history, is approaching, raising the possibility of short-term selling pressure on the market. However, the prevailing view is that selling pressure will be limited.

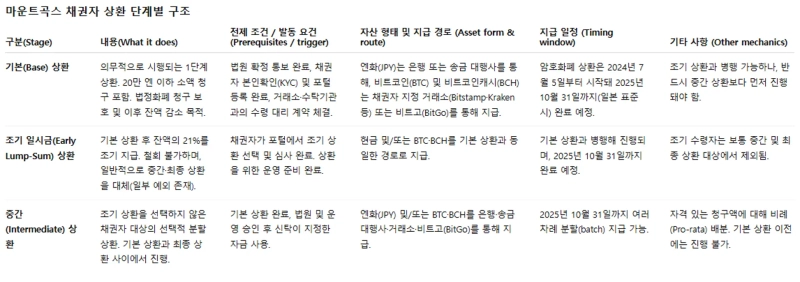

On the 20th (Korea time), crypto outlet CryptoSlate reported that Mt. Gox's creditor repayment deadline is scheduled for October 31 this year. Repayments are being carried out in three stages (basic · early repayment · interim), and the entire process is reportedly mostly in the final stages.

About 34,689 bitcoins (about $3.7 billion) remain in wallets related to Mt. Gox, and of the 142,000 total to be repaid, 107,000 have already been delivered to creditors. Of these, 59,000 have moved to exchanges, and 33,000 are held by custody firm BitGo.

The outlet said, "Assuming the current rate of inflow to exchanges remains the same, up to 22,000 bitcoins of the remaining amount could enter exchanges in the short term," but added, "however, because the repayments are not happening all at once and are being spread across exchanges, custodians, and over-the-counter venues, the possibility of a sharp price decline is limited."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)