Editor's PiCK

Lee Eok-yeom, Chairman of the Financial Services Commission: "Pursuing Phase 2 Digital Asset Law…Establishing a regulatory framework for stablecoins, etc."

Summary

- The Financial Services Commission said it is pursuing Phase 2 digital asset legislation that includes stablecoin regulation and public regulation of exchanges.

- The FSC said it plans to include operator regulation, improvements to listing and disclosure systems, and the introduction of a stablecoin management framework in the Digital Asset Basic Act.

- It said it will introduce an issuer authorization system, guarantee of redemption rights, and an obligation to hold reserve assets of at least 100% for stablecoins to enhance market soundness and investor confidence.

The Financial Services Commission said it is pursuing Phase 2 digital asset legislation that includes regulation of stablecoins (virtual assets pegged to fiat currency) and the transition of exchanges to public regulation.

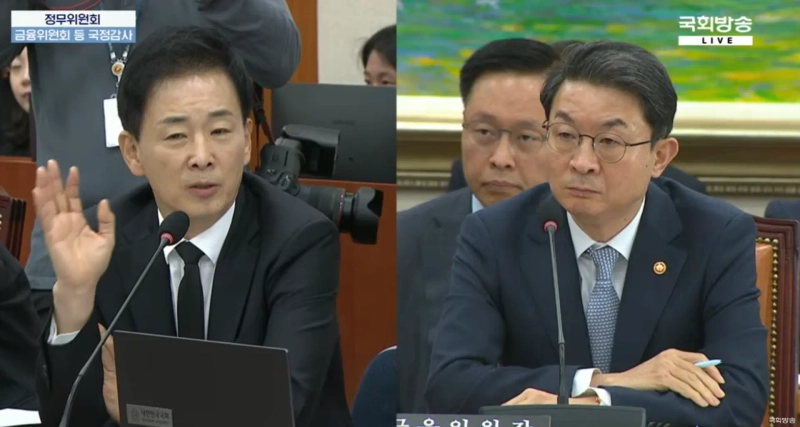

On the 20th, at an audit by the National Assembly's Political Affairs Committee, Lee Eok-yeom, Chairman of the Financial Services Commission, said, "We are preparing Phase 2 legislation that includes regulation of stablecoins," and added, "We will actively participate in parliamentary discussions."

The FSC plans to include in the 'Digital Asset Basic Act' ▲terminology revisions, ▲strengthened regulation of operators, ▲improvements to listing and disclosure systems, and ▲the introduction of a stablecoin management framework.

First, it will change 'virtual assets' to 'digital assets' and add the concept of distributed ledgers to clarify the legal definition.

Also, through Phase 2 legislation, the FSC plans to include exchanges' listing and disclosure obligations in the law, strengthening listing·delisting criteria, trading suspension procedures, and disclosure items to the level of the stock market. For stablecoins, it plans to introduce an issuer authorization system, guarantee of redemption rights, and an obligation to hold reserve assets of at least 100%.

Chairman Lee said, "We will enhance market soundness and secure investor trust," and, "We will support legislation in cooperation with relevant agencies."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)