Summary

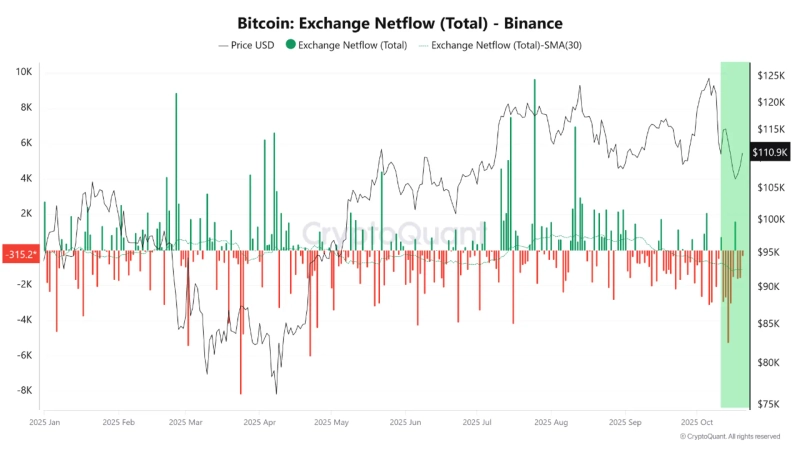

- "Binance"'s Bitcoin net inflows have decreased markedly over the past few weeks.

- This decrease in net inflows indicates that Bitcoin is gradually being accumulated in the market.

- The contributor analyzed that this phenomenon could contribute to alleviating supply pressure and Bitcoin price stability in the long term.

Binance's Bitcoin (BTC) net inflow indicator has shown a marked decline over the past few weeks.

On the 21st (Korean time), CryptoQuant contributor Bukkakesumeshi said in a report, "Binance's Bitcoin net inflow 30-day moving average (SMA30) remains in negative (-) territory," adding, "This means that outflows from the exchange exceed inflows, suggesting that Bitcoin is gradually being accumulated in the market."

The contributor went on to say, "It is difficult to judge the overall trend based solely on daily inflows and outflows, but based on long-term averages, investors have become more inclined to hold rather than sell," and analyzed, "This trend generally aligns with a market 'accumulation phase'."

The conclusion is that, in this situation, Bitcoin may find price stability. The contributor added, "Some in the market believe that a decrease in net inflows could reduce trading liquidity in the short term, but in the long term it could alleviate supply pressure and contribute to Bitcoin price stability."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)