Summary

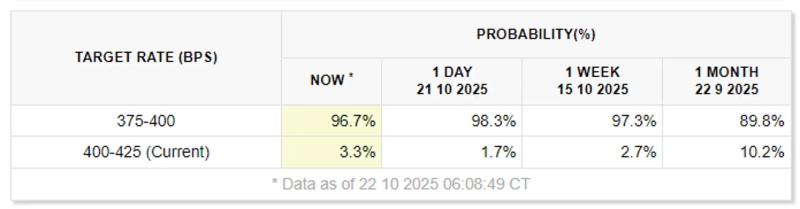

- CME FedWatch reported that the Fed's chance of a 25bp cut in the benchmark interest rate at the October FOMC is 97.3%.

- It also said the Fed's cumulative chance of a total 50bp cut by December reached 95.5%.

- It reported that market expectations for the Fed's easing stance this year have strengthened due to price stabilization and economic slowdown.

The United States Federal Reserve (Fed) appears to have a probability exceeding 97% of cutting the benchmark interest rate by 25bp (0.25%point) at the October Federal Open Market Committee (FOMC) meeting.

According to CME FedWatch on the 23rd (local time), the Fed's probability of cutting rates by 25bp at the October meeting is expected to be 97.3%, and the probability of holding steady is 2.7%.

Additionally, on a cumulative basis through December, the Fed's probability of cutting a total of 50bp reached 95.5%. Meanwhile, market expectations have strengthened that the Fed will maintain an easing stance this year as recent price stabilization and signs of economic slowdown coincide.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)