Editor's PiCK

Bitcoin on a Roller Coaster… Ethereum Sideways · Solana Strength [Lee Su-hyeon's Coin Radar]

Summary

- This week Bitcoin experienced high volatility due to uncertainty around the U.S.-China summit and U.S. monetary policy issues, but the confirmed summit schedule and ETF inflow expectations keep the year-end bullish outlook intact.

- Solana showed strength after Hong Kong formally approved a spot ETF, and the surge in trading volume and maintained key support were cited as positive signals.

- This week Flow implemented a technical upgrade to enhance Ethereum compatibility, and depending on the upgrade's reception, an increase in Flow-based projects and coin demand is expected.

<Lee Su-hyeon's Coin Radar> examines the flow of the crypto asset (cryptocurrency) market over the week and provides in-depth commentary on the background. Beyond a simple listing of prices, it analyzes global economic issues and investor movements in three dimensions to offer insights that can gauge the market's direction.

Major Coins

1. Bitcoin (BTC)

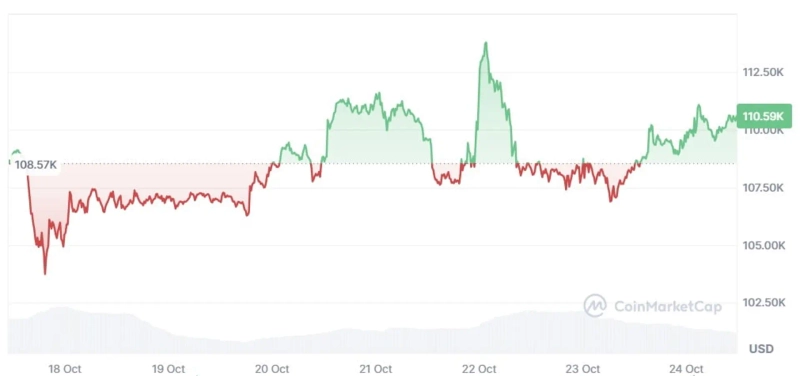

This week Bitcoin really rode a roller coaster. It attempted a rebound early in the week, then returned to a downtrend, and as of the 24th it successfully rebounded and is trading around 111,000 dollars on CoinMarketCap. There were multiple factors behind such large swings.

The biggest was uncertainty around the U.S.-China summit. On the 22nd (local time), U.S. President Trump said the meeting with President Xi Jinping "will be successful" but also said "the meeting may not take place at the end of this month," which shook the market. Adding to that, news that the U.S. is considering restrictions on semiconductor and software exports to China further tightened investor sentiment.

The U.S. consumer price index (CPI) for September, to be released at 9:30 p.m. today, also affected market nerves. If the CPI does not deviate significantly from expectations, the likelihood of two additional rate cuts this year is higher, but if it comes out higher than expected, the U.S. Federal Reserve (Fed) could slow the pace of rate cuts. That caution spurred short-term selling.

Still, uncertainty was partially resolved overnight as a meeting between President Trump and President Xi Jinping was confirmed. The White House announced the two leaders will meet on the 30th of this month. The market reacted immediately to the news, and Bitcoin rebounded to regain the $110,000 level.

In the short term there remains the possibility of further corrections. Omkar Godbole, a CoinDesk analyst, forecast that "the on-balance volume (OBV) indicator," widely used to confirm the persistence of price trends, has turned downward and there is a possibility of being pushed below 100,000 dollars. Jeff Cundick, head of digital asset research at Standard Chartered (SC), also analyzed that "Bitcoin could fall below 100,000 dollars within the year." Technically, 107,300 dollars is considered an important support level; if this line breaks, it could slide to the high 99,000-dollar range.

However, as long as inflows into exchange-traded funds (ETFs) and an accommodative monetary policy stance persist, the year-end bullish outlook remains valid. Cundick said, "Bitcoin could surpass 200,000 dollars by year-end despite large forced liquidations and President Trump's tariff threats," adding, "continued inflows into spot Bitcoin ETFs will fuel price increases." U.S. investment bank TD Cowen also said, "Globally, Bitcoin adoption cases are rapidly increasing," projecting that "Bitcoin will reach 141,000 dollars on December 14 this year," supporting the year-end bullish view.

2. Ethereum (ETH)

Ethereum has shown range-bound movement over the past few weeks. This week it has been trading sideways around the 3,800-dollar level.

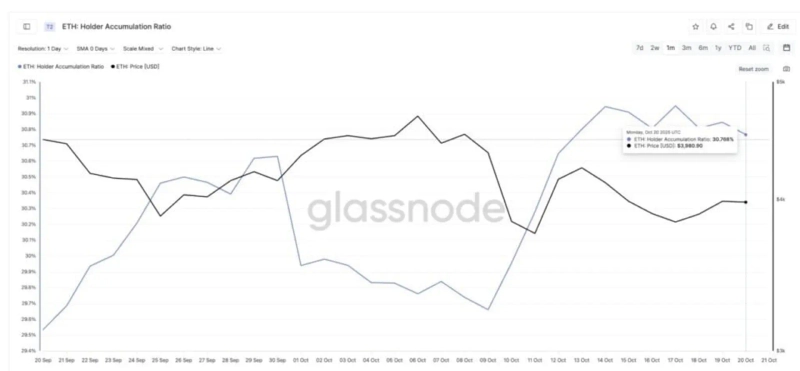

Several factors contributed to this stagnation. First, whale selling and slowing accumulation have continued. According to Glassnode, since the 20th whale addresses' Ethereum holdings decreased from 106,000,000 to 104,600,00.

Also, the holder accumulation ratio (HAR) for Ethereum has stalled from 30.77%, weakening new buying. Analysts say that without new money flowing into the market, the price cannot find a clear direction.

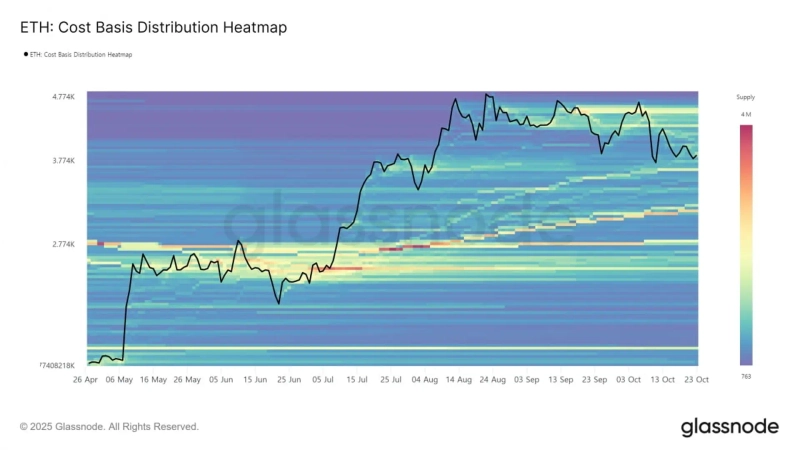

The Ethereum cost-basis distribution (CBD) map shows a strong resistance band in the 3,955–4,015-dollar range. About 1,060,000 ETH were purchased in this range. Because there is a structure where profit-taking occurs as Ethereum approaches 4,000 dollars, it is inevitable that the price will trade sideways below the resistance band.

However, there remains hope that the scheduled 'Fusaka' upgrade toward year-end will act as a catalyst for a rebound. During last year's 'Dencun upgrade,' Ethereum also rode an uptrend and surpassed 4,000 dollars. U.S. crypto media Cointelegraph said, "Ethereum is building momentum by holding off declines at a strong support band," and added, "it needs to break through the neckline resistance at 3,950–4,000 dollars and the 50-day exponential moving average (EMA) to secure a strong upward trend. If it clears this range, it could rise to 4,280 dollars by the end of the month or early next month."

Crypto analyst Ash Crypto offered a similar analysis, saying, "If the current pattern persists, there is room to rise to 5,000 dollars by year-end, and at most to 7,000 dollars," and "to do so, securing 4,200 dollars as a support is important."

3. XRP (XRP)

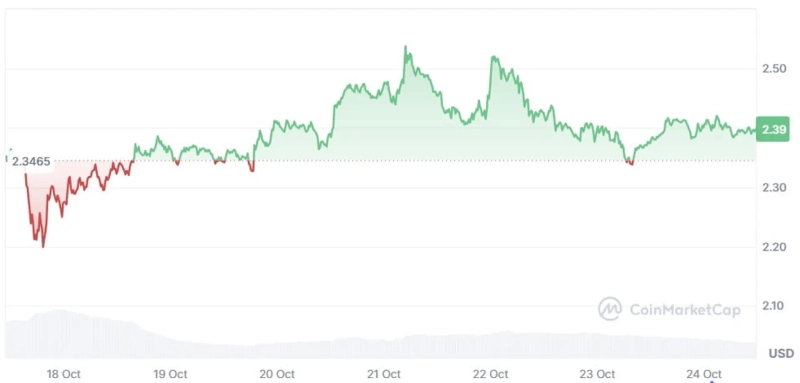

XRP was more stable than other altcoins this week. According to CoinMarketCap, its weekly loss was in the 1% range, and after rebounding on the 20th it has relatively well maintained gains and is currently trading in the 2.4-dollar range.

The recent rebound was influenced by news that Evernorth, a venture supported by Ripple, is pursuing a Nasdaq listing. Reuters reported on the 20th that Evernorth is pursuing a Nasdaq listing through a special purpose acquisition company (SPAC) merger. The company plans to raise more than 1 billion dollars through the listing and strategically reserve XRP. Ripple co-founder Chris Larsen also invested 50 million XRP in the company, and Japan's SBI Holdings provided 200 million dollars in support.

The U.S. Fed's consideration of a new bank account for crypto firms called the 'Skinny Master Account' is also seen as a positive. Under the current system, crypto firms had to go through existing commercial banks to access the Fed's payment network.

If implemented, this system would allow crypto firms to access the Fed's payment network directly without a partner bank. Ripple has already applied for a U.S. federal banking license and a master account, so if this system is implemented, Ripple — which targets financial infrastructure — could move closer to its vision.

In the short term, the key levels for XRP's price flow are the 2.32-dollar support and the 2.55-dollar resistance. Cointelegraph said, "If the downtrend continues, XRP could be pushed down to 2.06 dollars, but conversely, if it breaks the 2.55-dollar resistance, it could switch to an uptrend."

There is of course optimism. In the long term, expectations for ETF approvals and the expansion of global financial networks remain. Oliver Michell, CEO of German venture capital firm Tokentus, said, "XRP is not just a coin but is becoming a complete financial infrastructure asset," and "in the long term it could rise to the 6–9 dollar range."

Coins in the Spotlight

1. Solana (SOL)

This week Solana succeeded in rebounding. On the previous day (the 23rd) it rose more than 2% to touch the 190-dollar level, and it is currently trading near 193 dollars.

The issue that influenced this rebound was the news that Hong Kong approved a spot Solana ETF. The Securities and Futures Commission (SFC) of Hong Kong officially approved a spot Solana ETF managed by China Asset Management on the 22nd, and the ETF is scheduled to be listed on the Hong Kong Exchanges and Clearing (HKEX) on the 27th. Hong Kong has already introduced spot ETFs for Bitcoin and Ethereum and expanded crypto products; this approval is significant as it means Solana has been incorporated into the regulated investment asset space.

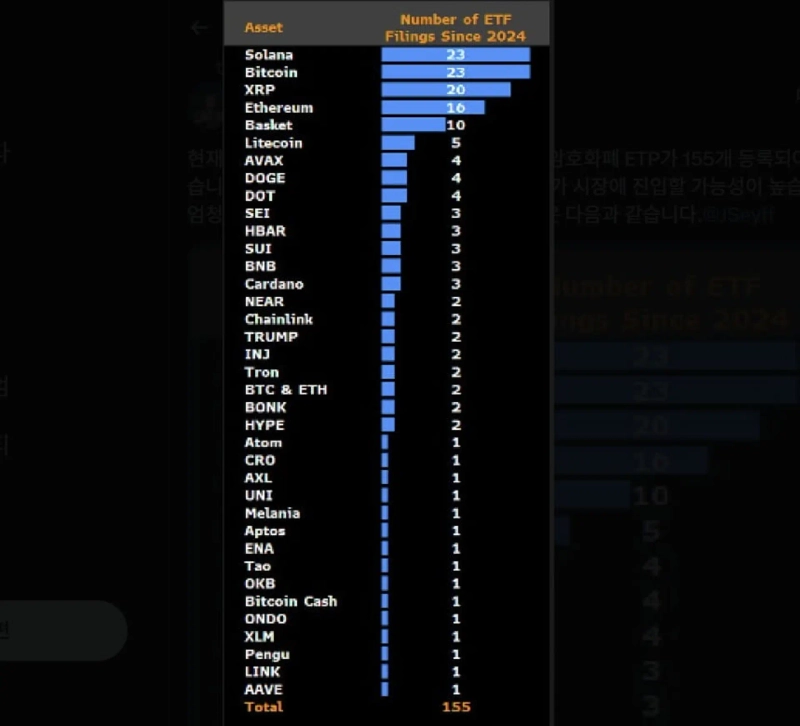

Solana also has the most ETF applications in the U.S. According to Bloomberg ETF analyst Eric Balchunas, of the 155 crypto ETF applications filed with the U.S. Securities and Exchange Commission (SEC), Solana accounts for 23 — the most. U.S. government shutdowns have delayed ETF approvals, but once the shutdown is lifted, a spot Solana ETF approval in the U.S. is likely.

Trading volume is also rapidly recovering. According to crypto outlet CoinOTag, Solana's trading volume surged by as much as 42% over the past 24 hours to exceed 8 billion dollars. This means buying pressure has steadily flowed in despite the recent short-term correction phase.

Technically, it is maintaining the 184-dollar support level stably. Chart patterns show a flag formation suggesting the potential for further upside. However, a clear break above 192 dollars must be confirmed for a full bullish transition. If buying weakens, 175 dollars could break, and below that an adjustment to 163 dollars is possible.

2. Flow (FLOW)

Flow traded sideways between 0.27 and 0.28 dollars this week. As of this report, it is trading at 0.277 dollars on CoinMarketCap, up about 1.7% from the previous day.

Flow had an important technical upgrade this week. On the 22nd, the 'Forte upgrade' was applied to the mainnet. The upgrade focuses on improving Ethereum compatibility and enhancing developer tools. In short, it makes the Flow blockchain faster and more efficient and easier for developers to use.

Flow is a blockchain specialized for games and non-fungible tokens (NFTs); at one point global sports leagues and events like the NBA and UFC issued official NFTs on Flow. Although the NFT market cooled and prices adjusted, the infrastructure is still regarded as solid.

Ultimately, this upgrade could be an important turning point for Flow. If the upgrade is well received by developers and the community, Flow-based projects may increase and demand for FLOW could rise.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)