Summary

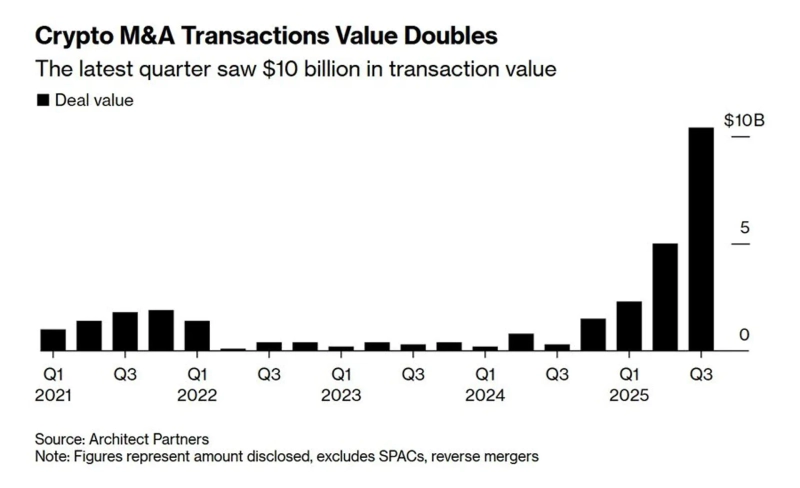

- It reported that in Q3 this year the scale of virtual asset M&A surpassed US$10 billion, setting a new record.

- That figure represented an over 30-fold increase compared with the same period last year.

- The M&A surge was attributed to expanded market entry by institutional investors and traditional financial firms and increased acquisition demand for infrastructure, security, and tokenization companies.

In the third quarter of this year, the global mergers and acquisitions (M&A) volume related to virtual assets (cryptocurrencies) exceeded US$10 billion for the first time.

On the 25th (local time), Unfolded said via X, "The scale of virtual asset M&A in Q3 this year surpassed US$10 billion, setting a new record. This is more than a 30-fold increase compared with the same period last year."

This surge is analyzed as the result of a combination of expanded market entry by institutional investors and traditional financial firms and increased demand for acquisitions of companies in the infrastructure, security, and tokenization sectors.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)